Home » Services » Automation » Asset tokenization transforming global finance

Real world asset tokenization can transform financial markets

Integration with Distributed Ledger Technologies is critical to realizing the full potential of tokenization.

The global financial markets create and deal in multiple asset classes, including equities, bonds, forex, derivatives, and real estate investments. Each of them constitutes a multi-trillion-dollar market. These traditional markets encounter numerous challenges in terms of time and cost which impede accessibility, fund liquidity, and operational efficiencies. Consequently, the expected free flow of capital is hindered, leading to fragmented, and occasionally limited, inclusion of investors.

In response to these challenges, today's financial services industry seeks to explore innovative avenues, leveraging advancements such as Distributed Ledger Technology (DLT). Using DLTs, it is feasible to tokenize assets, thus enabling issuance, trading, servicing and settlement digitally, not just in whole units, but also in fractions.

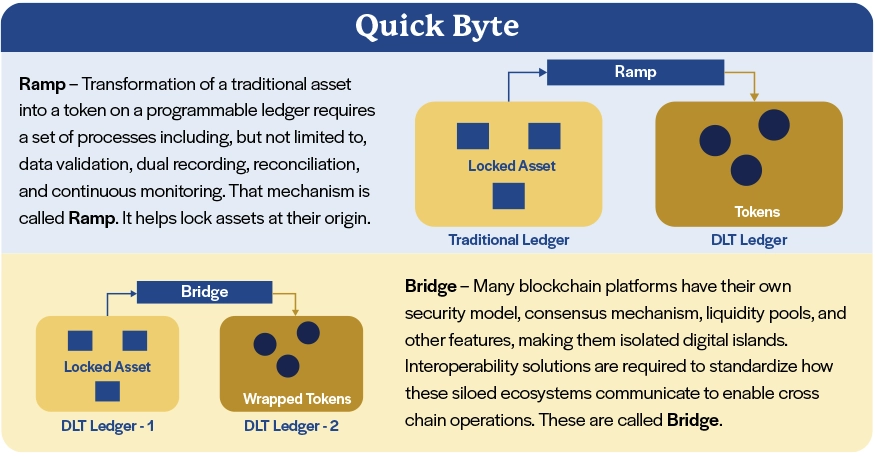

Asset tokenization is the process of converting and portraying the unique properties of a real-world asset, including ownership and rights, on a Distributed Ledger Technology (DLT) platform. Digital and physical real-world assets, such as real estate, stocks, bonds, and commodities, are depicted by tokens with distinctive symbols and cryptographic features. These tokens exhibit specific behavior as part of an executable program on a blockchain.

Many domains, especially financial institutions, have started recognizing the benefits of tokenization and begun to explore this technology. Some of the benefits are fractional ownership, increased liquidity, efficient transfer of ownership, ownership representation and programmability.

With the recent surge in the adoption of tokenization, a diverse array of platforms has emerged, paving the way for broader success, but at the same time creating fragmented islands of ledgers and related assets. As capabilities mature and adoption grows, interconnectivity and interoperability across ledgers representing different institutions issuing/servicing different assets could improve, creating a better integrated market landscape. This would be critical to realizing the promise of asset tokenization using DLT.

Read our Perspective Paper for more insights on asset tokenization and its potential to overcome the challenges, the underlying technology, successful use cases, and issues associated with implementation.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touch