An agile sprint for financial data

How Iris helped a mega sportswear brand’s global operations and financial reports go flexible, agile, and analytical.

Among the world’s largest manufacturers of sportswear, the client sells its products in more than 120 countries and employs more than 13,000 people.

To significantly reduce turnaround time and ease associated with report creation.

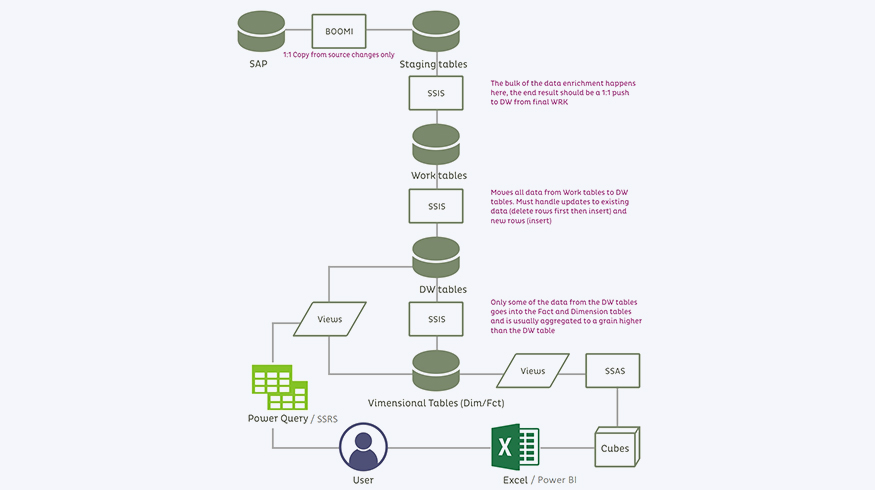

Microsoft SQL Server’s Analysis Services (SSAS), Microsoft SQL Server Integration Services (SSIS), Microsoft SQL Server Reporting Services (SSRS), Boomi AtomSphere, and Power BI.

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Our experts can help you find the right solutions to meet your needs.

Get in touch