Home » Industries » Insurance Technology Services » Domain-specific Offerings

Domain-specific Offerings

Core Insurance Services

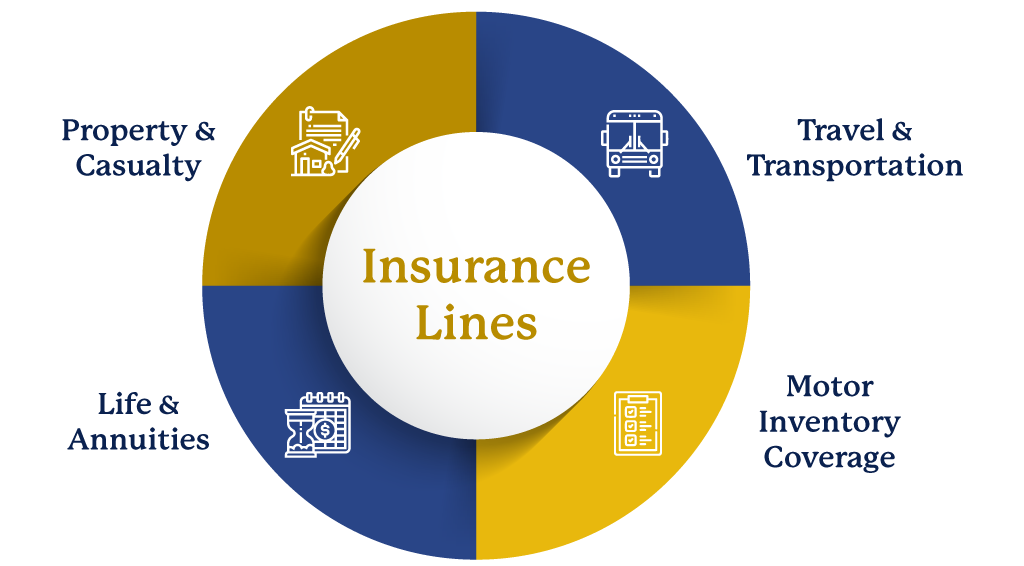

Iris enables Insurance enterprises to meet their growth objectives through future-ready business systems built on modern technologies. Our services and solutions streamline various Insurance processes ranging from customer acquisition to fairer claim settlements. We strategize our InsurTech solutions and services to ensure specific client needs are met without impacting live business functions and eliminating bottlenecks. Supporting insurance functions across various Insurance lines, including Property & Casualty, Life & Annuities, travel and transportation— we help insurers to calibrate their retail and corporate offerings. Our services have significantly contributed to increased customer satisfaction and improved net promoter scope for several Insurance companies worldwide.

Iris insurance technology service and solutions expertise spans around:

- Claims management

- Policy commissioning

- Agency information service

- Quote comparison and market analysis

- Motor inventory coverage

- Property & casualty

Investment Banking Services for Insurance Enterprises

- Global trade matching and allocation

- Managed accounts reporting

- Counterparty capital calculation and reporting

- Pricing and position management

- Combinatorial analytics and algorithmic strategies

- Cash and client reporting system

Trading and Risk Management

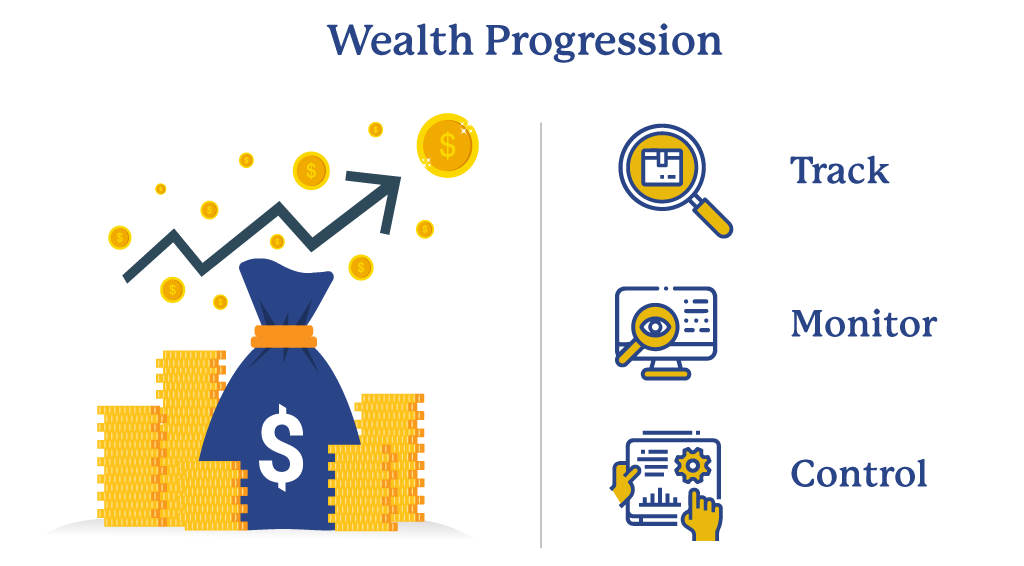

Insurance businesses sustain through their wealth development streams, which are strongly coupled with trading and market portfolio investments. We provide well-integrated platforms with market-leading stock exchanges, enabling insurance entities to understand market behavior in-depth. Our insurance technology experts build predictive models by aggregating reference data and trading platforms that forecast how the market will react to changing conditions. Adequately resilient, highly available, and housed in a secure infrastructure, our solutions are developed to adhere to industry regulations and compliance. Working collaboratively with Banking, Financial Services and Insurance enterprises has honed our competencies in developing various solutions that strengthen our clients’ wealth and investment portfolios:

- End-to-end trading solutions

- Exchange connectivity, price streaming and trade analytics

- Reference data and trading platform aggregation

- Regulatory reporting

- Anti-money laundering systems

- Enterprise risk management

Contact Us

Thank you for getting in touch

We appreciate you contacting us. We will get back in touch with you soon.

Have a great day.

Industries

Company