Home » Industries » Insurance Technology Services » Technology Offerings

Technology Offerings

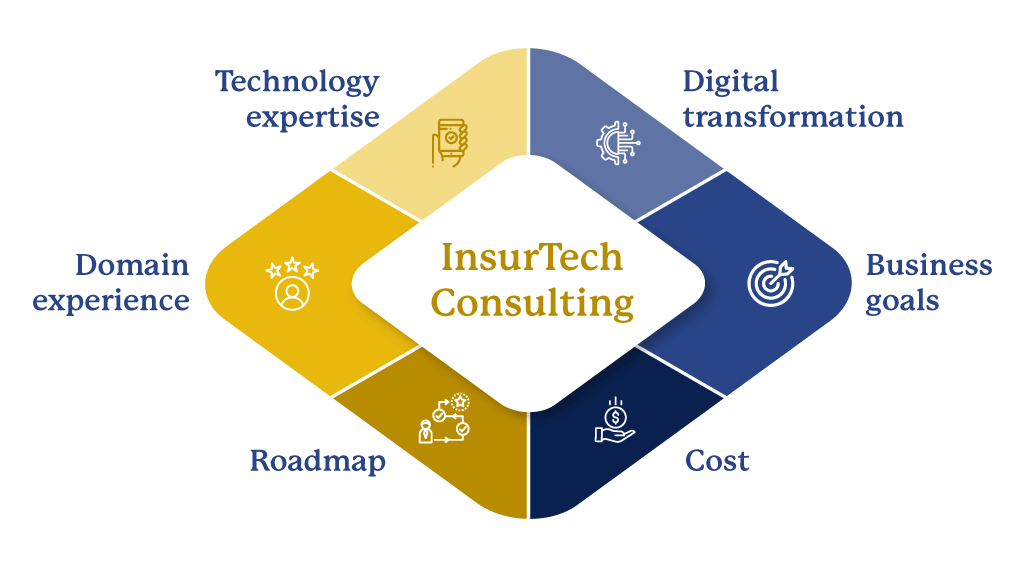

Consulting and System Transformation

Dynamic market trends and soaring customer demands are pressing insurance businesses to diversify their services and products. Shifting from legacy models to modernized tech-powered systems can help improve market competitiveness and customer experiences. Digital transformation provides insurers an opportunity to advance business agility, scalability, and growth while meeting critical challenges. Iris technology experts have a strong understanding of Insurance services. This brings assorted experience from an experienced workforce and decades of InsurTech solutions delivery around consulting and portfolio diversification. Considering IT as a mandate enabling function, we curate the right digital transformation path for the insurance enterprises that assist in divesting IT services from their core business. While handling IT and IT systems estate, we help insurers focus on their core offerings and develop new business and revenue streams for their businesses faster.

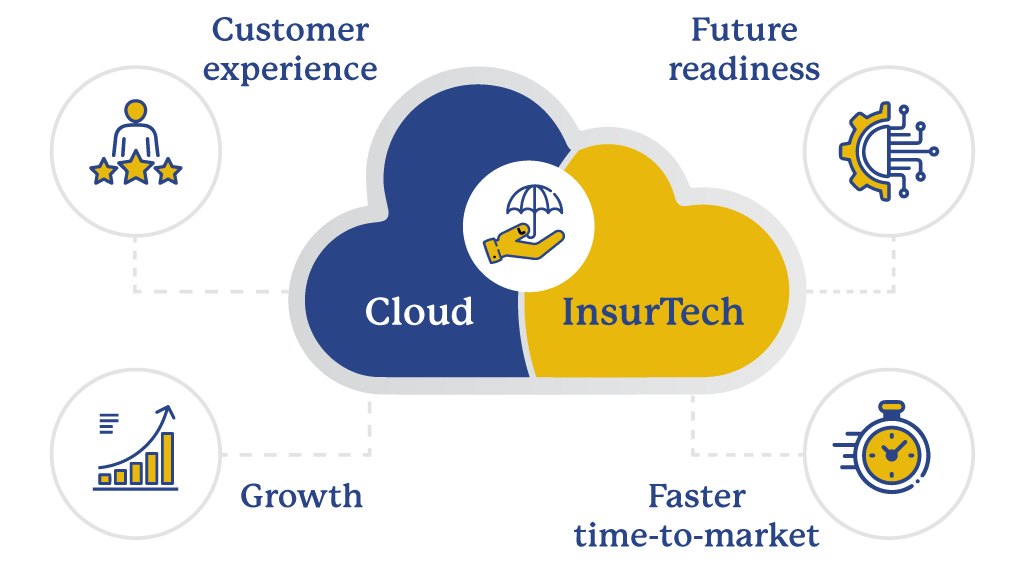

Cloud Migration and Tech Modernization

With extensive expertise in rendering digital transformation services, Iris delivers dependable systems and technology modernization solutions for insurance businesses. In line with the changing technological landscape of the Insurance industry, we transform the existing systems into future-ready applications through re-platforming, re-factoring, and cloud-native re-writing. We have enabled several insurance companies to capitalize on greater business opportunities by migrating on-premise estate and application infrastructure to cloud. Our grey screen application modernization makes them accessible on hand-held devices, allowing insurers to expand their outreach multifold at a reduced total cost of ownership (TCO). Iris Insurance technology and systems modernization services span the following critical systems:

- Customer Relationship Management

- Agent and Consumer Management

- Enterprise Resource Planning (ERP)

- Workforce Management

- Service Management and Workplace Services

- Insurance SaaS (Software as a Service) Applications

- Applicant Management

- Insurance Catalogue and Asset Management

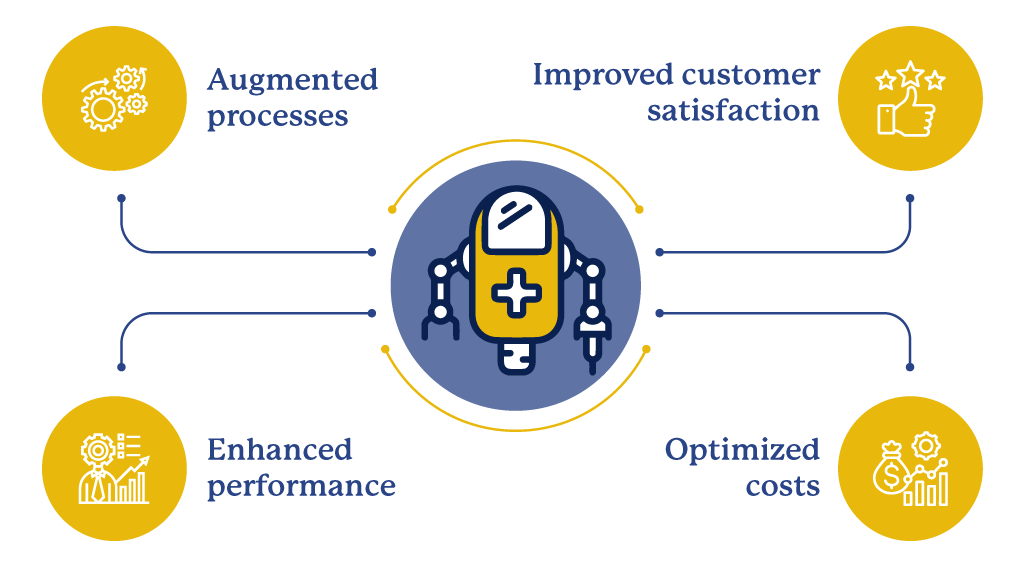

Robotic Process Automation

Robotic Process Automation (RPA) offers agility to any business by transforming mundane, repetitive, transactional, and several administrative tasks into trained, scripted procedures. Insurance processes automation provides the ability to pivot as per changing needs of micro and macro-economic factors. Iris helps insurers achieve enormous business benefits, including customer onboarding, KYC (Know-Your-Customer), claim processing and customer experience through seamless RPA implementations. Our automation services have assisted several Fortune 500 insurance companies in scaling their performance while significantly reducing business overheads. Some of the insurance businesses process automation use cases that Iris has invested in include:

- End-to-end claims processing and management

- Insurance operations transformation

- Claims and policy underwriting

- Sales and business development (campaigns and promotions)

- Customer support requests management

- Insurance and reinsurance

- Rate adjustments following changes in micro and macro-economic factors

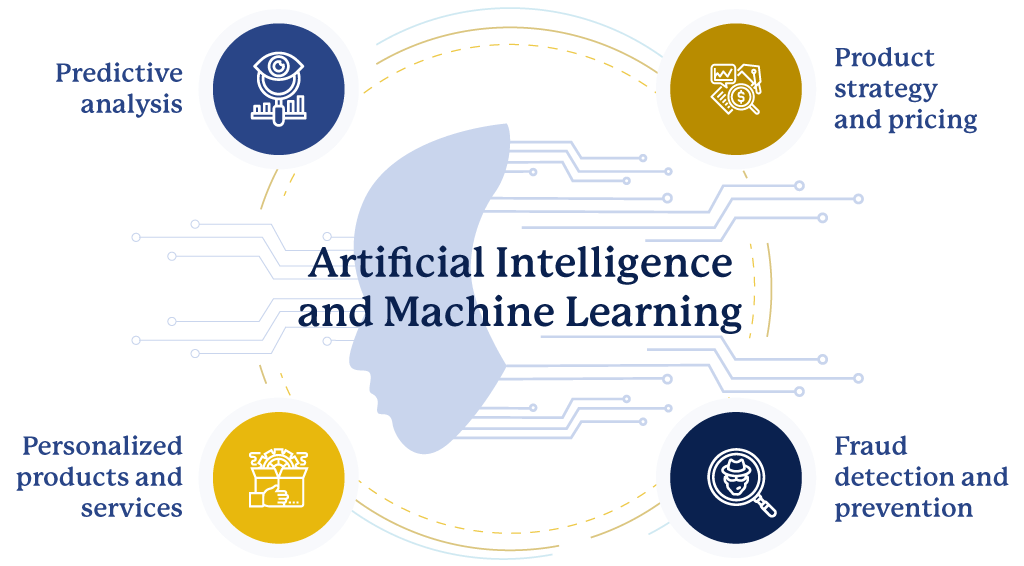

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) provides the ability to learn from historical data, market trends, patterns impacting the business. Machine Learning (ML) technologies are used to develop future-proof, scalable, cognitive and predictive models. Iris insurance technology services let insurers leverage the data captured from various sources to unearth actionable insights, build predictive models, and deliver a superior customer experience. Ues of AI and machine learning powers up divesre insurance functions, including product strategy, fraud prevention, claim processing, risk mitigation, and regulatory compliance. Our InsurTech solutions with AI and ML as underlying technologies enable insurers to:

- Predict market risks

- Improve insurance distribution, liability and risk identification processes

- Strategize product pricing and associated risks

- Segment customers based on various factors

- Personalize offerings based on customers’ historical and behavioral data

- Predict customer lifetime value

- Balance workstreams for agents

- Detect frauds at early stages and forecast volumes

- Inspect and analyze damages

- Reduce turnaround time by deploying self-learning virtual and live agents

Contact Us

Thank you for getting in touch

We appreciate you contacting us. We will get back in touch with you soon.

Have a great day.

Industries

Company

Copyright © 2026 Iris Software, Inc. All rights reserved

Bring the

future into focus.

Copyright © 2026 Iris Software, Inc. All rights reserved

Connect With

Copyright © 2021 Iris Software, Inc. All rights reserved

We use cookies to personalize content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners in accordance with our Privacy Statement. You can manage your preferences in Cookie Settings. By using this website, you agree to the use of cookies.

Manage consent

Privacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.