Home » Industries » Insurance Technology Services » Our Differentiators – Insurance – Iris Software

What Makes Iris Different

Iris follows a “Customer First” principle, which is etched permanently in the way we deliver InsurTech services ranging from consulting to managed services to transform digitally. We enable our clients’ digital transformation journeys with innovative solutions, indigenous frameworks, and accelerators. Our services help insurers deliver exceptional services to their customers and capitalize on opportunities through focused and personalized outreach. Iris helps organizations grow and diversify their offerings to meet scaled business needs, including customer experience, sustainability, and security. We leverage Cloud, Data & Analytics, and Automation technologies to build resilient InsurTech solutions. Our services have significantly impacted technological advancement for leading global insurers and helped them drive successful digital transformation journeys.

Faster Time-to-Market

Having served global corporations with end-to-end insurance technology services and accelerators, Iris has gained an edge in understanding the needs of the insurance businesses. With continually disrupting economies and market trends, well-in-time product launch is one of the biggest challenges. Our cloud practitioners transform monolith insurance applications into microservices. We make application development collaborative and agile for insurers by automating the product design processes. Iris cloud enablement and automation frameworks help enterprises deliver custom builds faster and quick-launch applications, reducing time-to-market.

Unparalleled Customer Experience

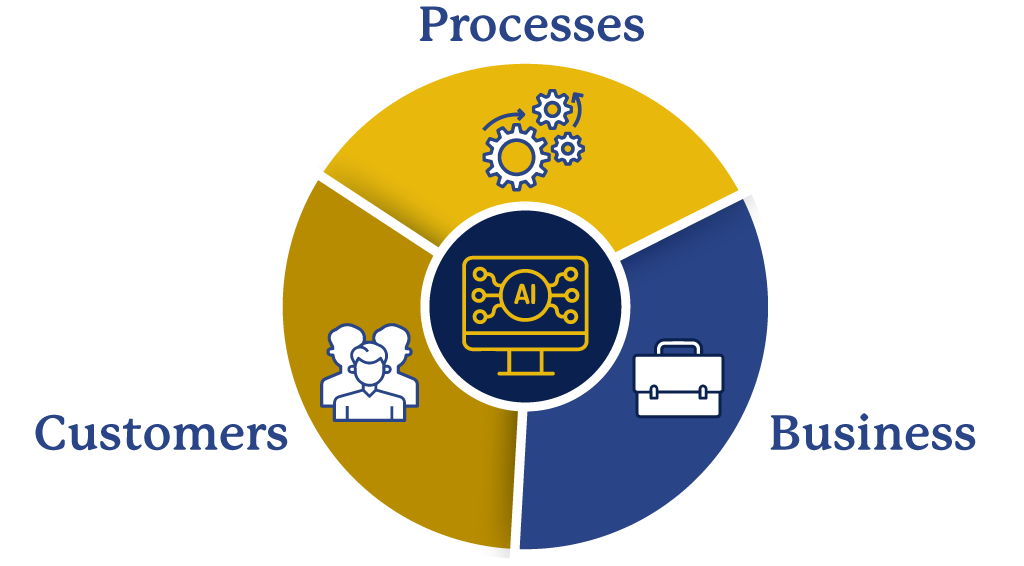

Ever-evolving technology is taking customers’ expectations to new levels. They want complete transparency with processes, pricing, risks, and value. Iris InsurTech services are strategized following a customer and business-centric approach, letting insurers stay in control of customer preferences, market dynamics, and operational costs. Our AI and data analytics-powered solutions help our clients better understand their customer sentiments by processing and analyzing historical and behavioral data from a host of other sources that impact insurance businesses. Adopting technology frameworks for real-time data visualizations, predictive models, and automated processes can deliver an exceptional customer experience.

Reduced Operating Costs

While not always the case, typically, insurers have the opportunity to reduce operating costs by reducing or eliminating hardware, licensing, and maintenance costs. Further, with automation, key areas such as customer onboarding, underwriting, and claims management can be streamlined and provide a better customer experience with greater efficiency and reduction in costs and timelines. All indispensable prerequisites when it comes to client acquisition and retention in today’s competitive environment.

Risk & Compliance

Regulators are inspecting insurance service companies more closely. The complexity is compounded by the industry’s dependency on outdated systems and growing data volumes. Organizations need to upgrade their IT infrastructures and use technologies such as machine learning, artificial intelligence, data analytics and cloud to tackle compliance concerns. Iris ensures that our InsurTech services support risk management, actuarial functions and internal audits adhere to necessary global standards and regulatory compliance.

Amplify Business Competencies

Many insurers have been very measured and cautious in launching new products; and concerned about the ROI given the significant upfront costs to modify underwriting, claims, billing systems, and the infrastructure. With the ability to spin up temporary test environments and utilize capabilities in SaaS platforms built on Cloud, Data and Analytics, and Automation— insurers can try out new products. If the product is a success, they are positioned to scale quickly. If the product fails, they can shut down the environment and deliver services with minimal capital outlay.

AI & Analytics-powered Calibration

Iris works closely with clients and end-user stakeholders to understand data semantics and develop data models that articulate value for insurance businesses. Our solutions help insurers identify market and customer trends and patterns to uncover actionable business insights from the data captured across channels and formats. Such insights are extracted using artificial intelligence and data analytics tools and techniques, and help insurers attain advanced business intelligence to shape offers and products, catering to specific customers’ needs and businesses objectives.

Upcoming Events

Contact Us

Thank you for getting in touch

We appreciate you contacting us. We will get back in touch with you soon.

Have a great day.

Industries

Company

Copyright © 2026 Iris Software, Inc. All rights reserved

Bring the

future into focus.

Copyright © 2026 Iris Software, Inc. All rights reserved

Connect With

Copyright © 2021 Iris Software, Inc. All rights reserved

We use cookies to personalize content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners in accordance with our Privacy Statement. You can manage your preferences in Cookie Settings. By using this website, you agree to the use of cookies.

Manage consent

Privacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.