The FIA (Futures Industry Association) is hosting a forum on treasury clearing on October 15, 2024 at the BNP Paribas Tower in New York City. The theme is The Evolution of Agency Clearing and a major focus is on clearing model development and new regulatory mandates. Attendees can have beneficial discussions on these topics with experienced financial services professionals from our New York City office who are attending: Jatin Shah and Ryan Fagan, Senior Client Partners, and Jesse Regina, Account Manager.

According to its website, FIA is the leading global trade organization for the futures, options and centrally-cleared derivatives markets, which are key to the global economy as they allow for price discovery and risk management. FIA represents various market participants, including exchanges and clearinghouses, executing brokers, proprietary trading firms and others. The U.S. SEC (Securities and Exchange Commission) has mandated the clearing of certain treasuries and repos (repurchase agreements) by 2026, and many participants in the cleared derivatives markets are impacted and making plans for their operations, technology, compliance, compliance.

Session topics will include: the benefits of expanding central clearing and considerations for implementing the SEC’s central clearing rule; how clearing reduces counterparty risk, settlement flows, fails, and establishes consistent and robust risk management practices for clearing; client clearing access models, margin practices, and the possibility of multiple central counterparty entrants to the U.S. treasury market, which pertain to the new mandate; bank capacity and structural needs for clearing success; and the challenges and opportunities seen by buy-side participants.

Iris is a key provider of technology services to leading global banks, wealth management, brokerage and financial services companies operating in the capital markets and related sectors and as counterparties. Per the FIA, asset managers, hedge funds and principal trading firms will all be affected by the clearing mandate, but each type of market participant will have different needs and operational challenges as they comply. Learn how these entities can and do apply Iris’ deep domain knowledge and experience and our advanced technology solutions - in AI / Gen AI / ML, Application Development, Automation, Cloud, DevOps, Data Science, Enterprise Analytics, Integrations, and Quality Engineering - to enhance security, scalability, cost-efficiency, and compliance in myriad platforms, processes and systems supporting clearing, settlement, currency and major transactions.

Contact Jatin, Ryan, Jesse and our entire team of experts and obtain more information here: Iris Software Banking and Financial Services. You can also read our pertinent, insightful perspective papers, including: Navigating Distributed Ledger Technologies; Real-world Asset Tokenization and Productionizing Generative AI Pilots.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchITC Vegas – The Frontier of Insurance Innovation

Meet Venkat Laksh, Global Insurance Lead, and Glenn DeGeorge, Client Partner, at the Frontier of Insurance Innovation - the Mandalay Bay in Las Vegas, Nevada, from October 15-17, 2024. That’s the theme, place and date of this year’s InsureTech Connect (ITC) annual conference, billed as the industry's largest, with 9,000+ attendees - insurers, reinsurers, brokers, risk managers, investors, and technology solution providers, such as Iris Software.

Technology and innovation topics, mainly related to AI/Generative AI and Data, again dominate the agenda as they continue to be pivotal to the insurance industry. Here are examples of the sessions each day:

- Insurance in the AI Age

- 100x your Underwriting & Claims Performance with AI

- Driving Profitability with AI-Powered Externalized Rating and Underwriting

- Insurdata Revolution: Unleashing the Power of Analytics for Innovation

- The Role of AI and Data Analytics in Commercial Insurance: Driving Efficiency and Accuracy

- Building the Future: Responsible AI and Gen AI in Property Insurance

- Beyond the Hype - The Real Potential of Gen AI for Individuals, Insurers and Our Industry

- How Insurance Firms Drive Award-Winning Customer Experiences with Data and AI

- Insuring for Cyber Losses for SME's: An AI-led Approach to Estimating Loss Coverages

- Claim Smarter: Leveraging AI for Precision, Speed and Sustainability

Insurers can ensure their enterprises are future-ready, scalable, secure, cost-efficient, and compliant, by smartly employing next-generation, emerging technology through a highly-experienced insuretech services provider. Talk about your digital priorities with Venkat Laksh, Global Insurance Lead, and Glenn DeGeorge, Client Partner, at ITC Vegas 2024, and learn how leading insurers are applying Iris solutions in AI/Generative AI/Machine Learning, Application Modernization, Automation, Cloud, Data Science, Enterprise Analytics, and Integrations, to advance their digital transformation goals.

You can also contact Venkat and Glenn to learn more about our InsurTech Services that help future-proof insurance enterprises here: Insurance Technology Services | Iris Software and read a few of our Gen AI success stories and insightful perspective papers, including Gen AI – powered summarization boosts underwriting policies and compliance workflow and How Gen AI can transform software engineering.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchJoin us at Reuters Future of Insurance USA 2024

Reuters Events hosts its annual Future of Insurance USA Conference on May 15-16, 2024, in Chicago, Illinois. The theme is Reset Strategy, Harness AI, Outsmart Disruption. Each thematic directive is a highly relevant priority for the 500+ strategic leaders and technology experts that are expected to attend the event. Venkat Laksh, Iris Software’s Global Lead – Insurance, will be one of the attendees.

With ongoing cost, regulatory and competitive pressures affecting insurance companies, the focus on innovation and technology, particularly AI, is unrelenting. It is the basis of near- and long-term strategies to enhance insurance product offerings, customer experience, operational efficiency, risk reduction and business growth. These concepts comprise the vast majority of the agenda topics for the Conference’s 100+ speakers, and will no doubt be at the forefront of peer networking conversations.

They are also the focus of the Insurtech services and solutions that Iris successfully provides to top property, casualty and life insurance carriers.

- Revolutionizing insurance enterprises with technology

- Implementing Generative AI

- Reimagining insurance product design

- Transforming with Data & AI

- Transitioning from legacy systems to cloud

- Elevating customer experience with innovation

- Ensuring flexible data foundations for AI success

- Linking and winning in digital transformation and innovation

Talk about your Insurtech priorities with Venkat Laksh, Iris’ insurance expert, at Reuters Future of Insurance USA 2024 and learn how insurers are applying Iris solutions in AI/ML, Application Modernization, Automation, Cloud, Data Science, Enterprise Analytics, and Integrations to leap ahead in their digital transformation goals.

You can also contact Venkat and learn more about our InsurTech Services and Solutions that help future-proof insurance enterprises here: Insurance Technology Services | Iris Software.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAI-powered summarization boosts compliance workflow

Client

A leading specialty property and casualty insurer

Goal

Improve underwriters’ ability to review policy submissions by providing easier access to information stored across multiple, voluminous documents.

Tools and Technologies

Azure OpenAI Service, React, Azure Cognitive Services, Llama-2-7B-chat, OpenAI GPT 3.5-Turbo, text-embedding-ada-002 and all-MiniLM-L6-v2

Business Challenge

The underwriters working with a leading specialty property and casualty insurer have to refer to multiple documents and handbooks, each running into several hundreds of pages, to understand the relevant policies and procedures, key to the underwriting process. Significant effort was required to continually refer to these documents for each policy submission.

Solution

A Gen-AI enabled conversational assistant for summarizing information was developed by:

- Building a React-based customized interactive front end

- Ringfencing a knowledge corpus of specific documents (e.g., an insurance handbook, loss adjustment and business indicator manuals, etc.)

- Leveraging OpenAI embeddings and LLMs through Azure OpenAI Service along with Azure Cognitive Services for search and summarization with citations

- Developing a similar interface in the Iris-Azure environment with a local LLM (Llama-2-7B-chat) and embedding model (all-MiniLM-L6-v2) to compare responses

Outcomes

Underwriters significantly streamlined the activities needed to ensure that policy constructs align with applicable policies and procedures and for potential compliance issues in complex cases.

The linguistic search and summarization capabilities of the OpenAI GPT 3.5-Turbo LLM (170 bn parameters) were found to be impressive. Notably, the local LLM (Llama-2-7B-chat), with much fewer parameters (7 bn), also produced acceptable results for this use case.

Our experts can help you find the right solutions to meet your needs.

Life Insurance & Annuity Conference 2024

With the theme, Powering Growth, the 2024 Life Insurance & Annity Conference, jointly hosted by LIMRA, LOMA, ACLI, and SOA, will be held at the Marriott Rivercenter in San Antonio, Texas, from April 15 to 17, 2024.

The Conference will feature peer networking and expert insights, with more than 30 workshops that will provide deep dives into topics of major significance to the insurance industry, including: technological and product innovation; financial crime and compliance; consumer, regulatory and resource demands; and market growth.

While you’re at this year’s Life Insurance & Annuity Conference, look up Venkat Laksh, Iris Software’s global lead in insurance, or contact him anytime afterward, to learn how insurers are applying our InsurTech Solutions - in AI/ML, Application Modernization, Automation, Cloud, Data Science, Enterprise Analytics, and Integrations – to power their growth, by optimizing business competencies, enhancing customer experiences, meeting challenges, and securing digital transformation.

You can also contact Venkat or learn more about Iris’ InsurTech Services and Solutions that help future-proof insurance enterprises here: Insurance Technology Services | Iris Software.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchHome » Industries » Insurance

The State of Central Bank Digital Currency

Innovations in digital currencies could redefine the concept of money and transform payments and banking systems.

Do you trust your data?

Data driven organizations are ensuring that their Data assets are cataloged and a lineage is established to fully derive value out of their data assets.

Central banking institutions have emerged as key players in the world of banking and money. They play a pivotal role in shaping economic and monetary policies, maintaining financial system stability, and overseeing currency issuance. A manifestation of the evolving interplay between central banks, money, and the forces that shape financial systems is the advent of Central Bank Digital Currency (CBDC). Many drivers have led central banks to explore CBDC: declining cash payments, the rise of digital payments and alternative currencies, and disruptive forces in the form of fin-tech innovations that continually reshape the payment landscape.

Central banks are receptive towards recent technological advances and well-suited to the digital currency experiment, leveraging their inherent role of upholding the well-being of the monetary framework to innovate and facilitate a trustworthy and efficient monetary system.

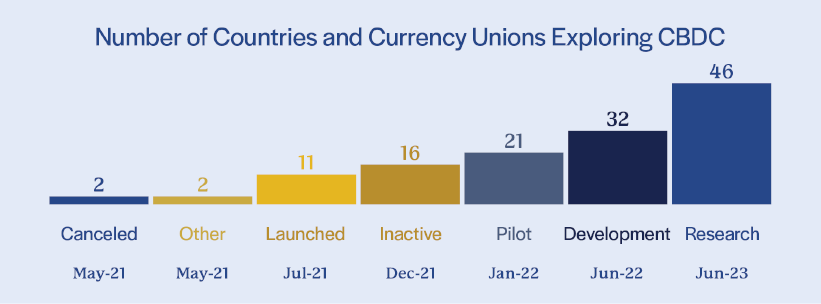

In 2023, 130 countries, representing 98% of global GDP, are known to be exploring a CBDC solution. Sixty-four of them are in an advanced phase of exploration (development, pilot, or launch), focused on lower costs for consumers and merchants, offline payments, robust security, and a higher level of privacy and transparency. Over 70% of the countries are evaluating digital ledger technology (DLT)-based solutions.

While still at a very nascent stage in terms of overall adoption for CBDC, the future of currency promises to be increasingly digital, supported by various innovations and maturation. CBDC has the potential to bring about a paradigm shift, particularly in the financial industry, redefining the way in which money, as we know it, exchanges hands.

Read our perspective paper to learn more about CBDCs – the rationale for their existence, the factors driving their implementation, potential ramifications for the financial landscape, and challenges associated with their adoption.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchMeet us at InsureTech Connect Vegas 2023

With the theme, “The Future of Insurance is Here,” InsureTech Connect’s annual conference, ITC Vegas, noted as the world’s largest gathering of insurance innovation, will be at Mandalay Bay in Las Vegas, Nevada, from October 31 to November 2, 2023.

The Conference features 14 educational tracks that will showcase insurance industry leaders, top use cases, and actionable insights relevant to the 9,000+ insurers, innovators and entrepreneurs from around the world who are expected to attend. Technology applications and advancements will be a major focus in each session.

Meet up with Venkat Laksh, Iris Software’s global lead in insurance, at ITC Vegas 2023 or afterward to learn how insurers are applying our InsurTech Solutions in automation, AI, data science, enterprise analytics and cloud, to amplify their business competencies and secure their digital futures.

You can also contact Venkat or learn more about the InsurTech services and solutions that help future-proof insurance enterprises here: Insurance Technology Services.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchConnect at the NMSDC 2023 Conference & Exchange

As a long-time, certified Minority Business Enterprise (MBE) and strategic partner of the National Minority Supplier Development Council (NMSDC), we are pleased to again participate in its annual Conference & Exchange. This year, it’s at the Baltimore, Maryland Convention Center from October 23-25, 2023.

Venkat Laksh, Global Lead - Insurance, will represent Iris. Connect with him there, or at any time, to learn how our advanced technology solutions and services benefit our clients’ digital transformation journeys as well as support their CSR and DEI commitments.

Iris’ successful growth journey over the past 32 years and our experience delivering Automation, Cloud, Data & Analytics, and Integrations, leveraging emerging tools like artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), to Fortune 500 and other companies in varied industries, including Financial Services and Insurance, sync perfectly with NMSDC’s mission and the Conference agenda. You can find those here: About (nmsdcconference.org).

The NMSDC Conference & Exchange provides several days of networking and educational opportunities for C-suite executives, supplier diversity and procurement professionals, and MBEs. Take the opportunity to connect with Venkat Laksh at the 2023 Conference or afterward to discuss how Iris’ capabilities can help your enterprise realize the benefits of future-ready technology.

You can also visit Industry-specific tech services to learn more and contact us.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchJoin us at the Women in Payments Symposium 2023

Each year, the Global Association of Women Leaders in Payments hosts annual forums in several regions around the world for women payments professionals to connect, share ideas, learn the latest trends and challenges in fintech and the payments market, and to advance change. These annual events usually feature a theme as well as presentations and workshops with many of the industry’s top female leaders.

Pallavi Bhargava, Client Partner, is attending the Women in Payments Symposium 2023 in Toronto, Canada at the Westin Harbour Castle Hotel on October 11 and 12. She will be available there and afterward to discuss how Iris Software’s capabilities help organizations in the payments industry realize the benefits of future-ready technology.

The theme of this Symposium is Future Focus. One of the session introductions nicely expresses why: “Banks and businesses…have embarked on a modernization journey, trying to re-imagine their systems and get ready for the world of tomorrow. While each institution has paved their own path, all are seeking common goals; integration into new technologies, cost reduction, improved risk and security management, and operational efficiency and many are yet to start.”

With the continual growth and evolvement of e-commerce, digital currencies, real-time payments, security, liquidity, and fintech, many banks and financial services and payment providers are applying emerging technologies in automation, cloud adoption, and advanced data & analytics to future-proof their businesses.

As an experienced provider of data engineering, enterprise analytics, automation, cloud, DevOps and integration solutions to banks and financial services companies that provide payment card processing and transactions, Iris is knowledgeable about the rapid advances in these areas and leveraging accelerators like AI/ML and NLP.

Further, Iris is PCIDSS 4.0 certified to ensure robust cyber security and compliance for our clients. The Payment Card Industry Data Security Standard applies to all entities involved in payment card processing, as well as all other entities that store, process, or transmit cardholder data and/or sensitive authentication data.

Visit Core Banking Solution: Banking Software Consulting Services to explore our innovative approach and strategies and to get in touch.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchNJ Top Workplace Award recipient three years in a row

This year’s Top Workplaces NJ Survey, conducted from January 3 to 19, 2023, validated the Iris Software work culture on various factors, establishing us as a top employer in NJ once again. Iris also was honored as a Top Workplace in NJ in 2021 and 2022.

An employee engagement firm located in Exton, Pennsylvania, Energage, conducts surveys of NJ employees on behalf of NJ.com, which organizes the annual Top Workplace NJ awards. It assesses companies on different measures to identify the top workplaces. Iris Software and all other firms in the survey were evaluated on four culture drivers— Perform, Align, Connect, and Coach.

Iris again scored a remarkable 93% employee participation rate in this year’s survey. On overall Employee Engagement, Iris’ score came in at 78%, surpassing by 39% this year’s IT industry benchmark score of 56% and registering an increase from last year’s score.

Two other notable metrics where employees rated Iris over 90%, nearly 10% higher than other companies in the survey, and increased its scores from last year, included:

- Iris Software motivates me to give my very best at work.

- I would highly recommend working at Iris Software to others.

Along with the increases in our overall score and the above compared to last year, components related to pay, work-life balance, and training also witnessed a significant jump in scores.

Stanley Mohan, Vice President of Human Resources for North America, stated, “We are very proud that 2023 is the third year in a row Iris Software is named a NJ Top Workplace. A big thank you goes to our employees for their contributions and efforts – they make a difference every day - and for thrice recognizing our continuous efforts to put them first by providing a positive workplace culture and excellent workplace experience.”

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchCompany