Client

Commercial banking unit of a large Canadian bank

Goal

Help lenders access information for complex lending applications on more timely basis and simplify onboarding of new users

Tools and Technologies

PyPDF2, Meta

Business Challenge

As a part of the credit adjudication process for a transaction, commercial bankers use an application to create summaries, memos and rating alerts as needed, which are instrumental for ongoing Capital at Risk (CaR) monitoring, Risk Profiling, Risk Adjusted Return on Capital (RAROC) computations, etc.

There is a significant amount of complexity involved in understanding this application due to the diversity in types of borrowers / loans, nature of collaterals, etc., e.g., How to create a transaction report for my deal? How to update an existing deal?

All of this information is spread across multiple user guides and FAQ documents that may run into hundreds of pages.

Solution

- Ringfenced a knowledge base comprised of the user guides of various functionalities (e.g., facility creation, borrower information, etc.)

- Built a custom-developed, React-based front-end for the conversational assistant to interact with the users

- Parsed, formatted and extracted text chunks from these documents using libraries such as PDF Miner, PyPDF2

- Created vector embeddings using sentence transformer embedding model (all-MiniLM-L6-v2) and stored as indices in the Facebook AI Similarity Search (FAISS) vector database

- Broke down the user query into vector embeddings, searched against the vector database and leveraged local LLM (Llama-2-7B-chat) to generate summarized responses based on the context passed to it by the similarity search

Outcomes

Our custom solution was a conversational agent built using Generative AI, which summarizes relevant information from multiple documents.

It significantly:

- Improved existing users’ ability to access relevant information on a timely basis

- Simplified the migration of bankers and integrations of lending applications resulting from merger or acquisition

Our experts can help you find the right solutions to meet your needs.

Meet us at the Open Banking Expo in Toronto

Meet Suneela Katikala and Pallavi Bhargava, our experienced client partners in the banking, financial services and payments technology space, at the Open Banking Expo on June 11, 2024 at the Metro Toronto Convention Centre in Ontario, Canada.

As financial institutions strive to rapidly implement the open banking initiative in Canada - more collaborative, secure, and efficient banking and payment systems - it is imperative that they work with technology providers with demonstrated agility, knowledge and IT expertise in these areas. For decades, Iris has accelerated the digital transformation journeys of major global and Canadian banks and financial services and payments enterprises.

Learn from Suneela and Pallavi how our solutions in AI / ML, Application Modernization, Automation, Cloud, Data Science, DevOps, Enterprise Analytics, Integrations, and Quality Engineering improved clients’ data quality, reliability and scalability; platform and systems efficiency; user interfaces and experiences; insight extraction and decision-making; and regulatory compliance. Also note that Iris is PCIDSS 4.0-certified to ensure robust cyber security and compliance for clients involved in payment card processing or that store, process, or transmit cardholder data and/or sensitive authentication data.

For more information on the benefits of our future-ready solutions, visit Iris Software Banking and Financial Services. Read our Perspective Papers on navigating Digital Ledger Technology and the state of Central Bank Digital Currency for more insights.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchConversational assistant boosts AML product assurance

Client

A large global bank

Goal

Improve turnaround time to provide technical support for the application support and global product assurance teams

Tools and Technologies

React, Sentence–Bidirectional Encoder Representations from Transformers (S-BERT), Facebook AI Similarity Search (FAISS), and Llama-2-7B-chat

Business Challenge

The application support and global product assurance teams of a large global bank faced numerous challenges in delivering efficient and timely technical support as they had to manually identify solutions to recurring problems within the Known Error Database (KEDB), comprised of documents in various formats. With the high volume of support requests and limited availability of teams across multiple time zones, a large backlog of unresolved issues developed, leading to higher support costs.

Solution

Our team developed a conversational assistant using Gen AI by:

- Building an interactive customized React-based front-end

- Ringfencing a corpus of problems and solutions documented in the KEDB

- Parsing, formatting and extracting text chunks from source documents and creating vector embeddings using Sentence–Bidirectional Encoder Representations from Transformers (S-BERT)

- Storing these in a Facebook AI Similarity Search (FAISS) vector database

- Leveraging a local Large Language Model (Llama-2-7B-chat) to generate summarized responses

Outcomes

The responses generated using Llama-2-7B LLM were impressive and significantly reduced overall effort. Future enhancements to the assistant would involve:

- Creating support tickets based on information collected from users

- Categorizing tickets based on the nature of the problem

- Automating repetitive tasks such as access requests / data volume enquiries / dashboard updates

- Auto-triaging support requests by asking users a series of questions to determine the severity and urgency of the problem

Our experts can help you find the right solutions to meet your needs.

Automated financial analysis reduces manual effort

Client

Commerical lending and credit risk units of large North American bank

Goal

Automated retrieval of information from multiple financial statements enabling data-driven insights and decision-making

Tools and Technologies

OpenAI API (GPT-3.5 Turbo), LlamaIndex, LangChain, PDF Reader

Business Challenge

A leading North American bank had large commercial lending and credit risk units. Analysts in those units typically refer to numerous sections in a financial statement, including balance sheets, cash flows, and income statements, supplemented by footnotes and leadership commentaries, to extract decision-making insights. Switching between multiple pages of different documents took a lot of work, making the analysis extra difficult.

Solution

Many tasks were automated using Gen AI tools. Our steps:

- Ingest multiple URLs of financial statements

- Convert these to text using the PDF Reader library

- Build vector indices using LlamaIndex

- Create text segments and corresponding vector embeddings using OpenAI’s API for storage in a multimodal vector database e.g., Deep Lake

- Compose graphs of keyword indices for vector stores to combine data across documents

- Break down complex queries into multiple searchable parts using LlamaIndex’s DecomposeQueryTransform library

Outcomes

The solution delivered impressive results in financial analysis, notably reducing manual efforts when multiple documents were involved. Since the approach is still largely linguistic in nature, considerable Prompt engineering may be required to generate accurate responses. Response limitations due to the lack of semantic awareness in Large Language Models (LLMs) may stir considerations about the usage of qualifying information in queries.

Our experts can help you find the right solutions to meet your needs.

Home » Industries » Banking & Financial Services » Banking

The State of Central Bank Digital Currency

Innovations in digital currencies could redefine the concept of money and transform payments and banking systems.

Do you trust your data?

Data driven organizations are ensuring that their Data assets are cataloged and a lineage is established to fully derive value out of their data assets.

Central banking institutions have emerged as key players in the world of banking and money. They play a pivotal role in shaping economic and monetary policies, maintaining financial system stability, and overseeing currency issuance. A manifestation of the evolving interplay between central banks, money, and the forces that shape financial systems is the advent of Central Bank Digital Currency (CBDC). Many drivers have led central banks to explore CBDC: declining cash payments, the rise of digital payments and alternative currencies, and disruptive forces in the form of fin-tech innovations that continually reshape the payment landscape.

Central banks are receptive towards recent technological advances and well-suited to the digital currency experiment, leveraging their inherent role of upholding the well-being of the monetary framework to innovate and facilitate a trustworthy and efficient monetary system.

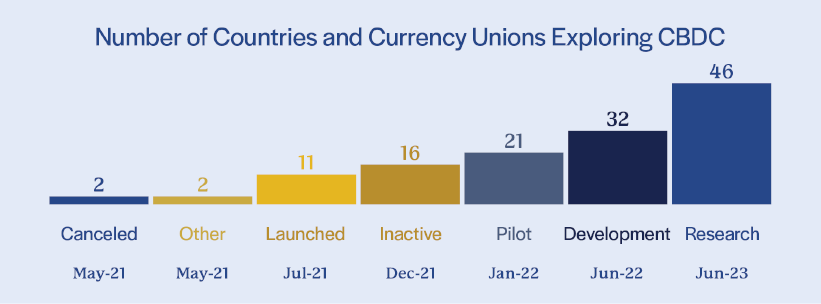

In 2023, 130 countries, representing 98% of global GDP, are known to be exploring a CBDC solution. Sixty-four of them are in an advanced phase of exploration (development, pilot, or launch), focused on lower costs for consumers and merchants, offline payments, robust security, and a higher level of privacy and transparency. Over 70% of the countries are evaluating digital ledger technology (DLT)-based solutions.

While still at a very nascent stage in terms of overall adoption for CBDC, the future of currency promises to be increasingly digital, supported by various innovations and maturation. CBDC has the potential to bring about a paradigm shift, particularly in the financial industry, redefining the way in which money, as we know it, exchanges hands.

Read our perspective paper to learn more about CBDCs – the rationale for their existence, the factors driving their implementation, potential ramifications for the financial landscape, and challenges associated with their adoption.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchTest Automation Speeds Model Risk Management System

Client

Top international bank

Goal

Fully automate the model risk management system framework to improve quality and confidence in testing results

Tools and technologies

Java, Selenium, Maven, TestNG, Git

BUSINESS CHALLENGE

The client's existing model risk framework was inefficiently handling functional testing aspects and risk scenarios due to lack of an end-to-end testing framework. Built on redundant, hard-to-debug, and non-scalable code, the system was unreliable for model risk testing. Test cases and controls were maintained and executed in Excel, eliminating parallel workflow abilities, tempering testing results, contributing to increased testing efforts and even delaying production launches in some cases. Scalability of testing using automation, running data-driven, end-to-end test flows, and restoring confidence in test results were the client's prime challenges.

SOLUTION

Iris built a lightweight and scalable new framework, providing 100% automated regression testing of functional test cases. Using simplified, customizable code that separated automation utilities and test functions, Iris' solution brought multiple improvements. Among them was faster test execution due to significantly reduced manual efforts. It also resulted in better quality and stability from the early identification of testing issues, enabling immediate corrective actions to occur. Another advantage of the solution was adaptability to multiple application areas due to ease of maintainability and traceability of code employed.

OUTCOMES

The client experienced several positive effects from the new, fully-automated solution:

- Acquired a 100% stable, scalable, reusable test framework

- ROI of 72%; payback period of less than 8 months

- 20% reduction in testing efforts for faster time to market

- Significant decrease in time required for ongoing maintenance of test scripts

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAnti-money laundering software saves $1M

Client

A top 5 global bank

Goal

Create a unified platform for anti-money laundering functions, analytics, and compliance implementations

Tools and technologies

Angular 5, Java, Open Shift, and DevOps

BUSINESS CHALLENGE

The client expanded its fraud and anti-money laundering (AML) monitoring functions, involving multiple lines of business and 15,000 employees. The scaled system led to the lack of standardization of frameworks and resultant adoption of disjointed, manual-intensive, and high-cost AML technology. The ongoing disconnect hindered the efforts of automating, consolidating; and implementing AML functions, enterprise analytics, and regulatory compliance efficiently throughout the organization.

SOLUTION

Iris optimized existing operations and technology investments by developing and implementing a unified point of access for the discrete AML functions, featuring micro-front-end architecture. Engineered to be horizontally scalable through containerization with common authentication and authorization gateways, the single user interface (UI) allows onboarding and control of multiple extended AML functions, including visualization of metrics.

OUTCOMES

- Hassle-free transition from multiple to a single UI

- Unified, streamlined user experiences with more effective sessions

- Creation of standardized deployment procedures for AML rules and applications

- Saving of nearly $1M on infrastructure costs

- Reduced infrastructure maintenance time

- Frictionless migration of applications to the cloud

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchReporting transformation with data science and AI

Client

One of the world's leading bank

Goal

Improve efficiency in disclosure and reporting

Tools and technologies

Python – SciPy, Pytesseract, NumPy, Statistics

BUSINESS CHALLENGE

The client relies upon a centralized operations team to produce monthly NAV (Net Asset Value) and other financial reports for its international hedge funds— from data contained in 2,300 separate monthly investment fund performance reports. With batch receipts of rarely consistent file formats – PDF, Excel, emails, and images— the process to read each report, capture key info, and, create and distribute new metrics using the bank’s traditional tools and systems was highly manual, time-consuming, error-prone, and costly.

SOLUTION

Iris developed a Data Science solution that rapidly and accurately extracts tabular data from thousands of variable file documents. Using a statistical, AI-based algorithm featuring unsupervised learning, it auto-detects, construes, and resolves issues for every data point, configuration, and value. Complex inputs are calculated, consolidated, and mapped as per predefined templates and downstream business needs, efficiently generating numerous, distinct, and required period-end financial disclosures.

OUTCOMES

- 90 - 95% reduction in operational efforts

- 99% accuracy in processing variable inputs

- Zero rework effort and cost

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchA playbook for banks on managing M&A integration

Client

Banks that have merged or acquired new businesses.

Goal

Manage migration and integration complexity post M&A.

Tools and technologies

The Iris business acquisition playbook for banks.

BUSINESS CHALLENGE

Solution

- Consolidate multiple acquisition playbooks to create a single standardized framework for their lending business

- Define insourcing steps for business and technology teams and create a migration strategy with quantifiable recommendations and a reusable checklist for insourcing activities.

- Assess capability and readiness and help them choose from insourcing options:

- Achieve full migration of data and systems

- Achieve partial migration of systems and data migration and integration

- Manage data integration and connectivity for lending business.

Outcomes

Related Stories

Gen AI summarization solution aids lending app users

Custom summarization solution using Gen AI eases lenders’ information access, complex app usage, and new user onboarding.

Conversational assistant boosts AML product assurance

Gen AI-powered responses enhance the operational efficiency of the AML global product assurance team and reduce cost.

Automated financial analysis reduces manual effort

Analysts in commercial lending and credit risk units are able to source intelligent information across multiple documents.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAnti-money laundering: managing regulatory risks

Client

A leading global bank with operations in over 100 countries

Goal

Address data quality and cost challenges of legacy AML application infrastructure

Tools and technologies

Hadoop, Hive, Talend, Kafka, Spark, ETL

BUSINESS CHALLENGE

The client’s legacy AML application infrastructure was leading to data acquisition, quality assurance, data processing, AML rules management and reporting challenges. High data volume and rules-based algorithms were generating high numbers of false positives. Multiple instances of legacy vendor platforms were also adding to cost and complexity.

SOLUTION

Iris developed and implemented multiple AML Trade Surveillance applications and Big Data capabilities. The team designed a centralized data hub with Cloudera Hadoop for AML business processes and migrated application data to the big data analytical platform in the client’s private cloud. Switching from a rule-based approach to algorithmic analytical models, we incorporated a data lake with logical layers and developed a metadata-driven data quality monitoring solution. We enabled the support for AML model development, execution and testing/validation, and integration with case management. Our data experts also deployed a custom metadata management tool and UI to manage data quality. Data visualization and dashboards were implemented for alerts, monitoring performance, and tracking money laundering activities.

OUTCOMES

The implemented solution delivered tangible outcomes, including:

- Centralized data hub capable of handling 100+ PB of data and ~5,000 users across 18 regional hubs for several countries

- Ingestion of 30+ million transactions per day from different sources

- Greater insights with scanning of 1.5+ Billion transactions every month

- False positives reduced by over 30%

- AML data storage cost reduced to <10 cents per GB per year

- Extended support to multiple countries and business lines across six global regions; legacy instances reduced from 30+ to <10

Related Stories

Gen AI summarization solution aids lending app users

Custom summarization solution using Gen AI eases lenders’ information access, complex app usage, and new user onboarding.

Conversational assistant boosts AML product assurance

Gen AI-powered responses enhance the operational efficiency of the AML global product assurance team and reduce cost.

Automated financial analysis reduces manual effort

Analysts in commercial lending and credit risk units are able to source intelligent information across multiple documents.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchCompany