Client

Among the world’s largest manufacturers of sportswear, the client sells its products in more than 120 countries and employs more than 13,000 people.

Goal

To significantly reduce turnaround time and ease associated with report creation.

Tools and technologies

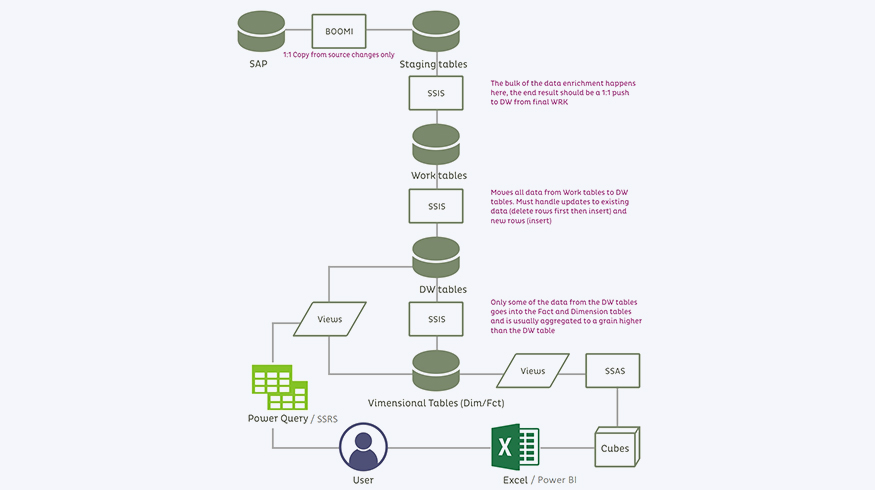

Microsoft SQL Server’s Analysis Services (SSAS), Microsoft SQL Server Integration Services (SSIS), Microsoft SQL Server Reporting Services (SSRS), Boomi AtomSphere, and Power BI.

BUSINESS CHALLENGE

SOLUTION

OUTCOMES

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchA playbook for banks on managing M&A integration

Client

Banks that have merged or acquired new businesses.

Goal

Manage migration and integration complexity post M&A.

Tools and technologies

The Iris business acquisition playbook for banks.

BUSINESS CHALLENGE

Solution

- Consolidate multiple acquisition playbooks to create a single standardized framework for their lending business

- Define insourcing steps for business and technology teams and create a migration strategy with quantifiable recommendations and a reusable checklist for insourcing activities.

- Assess capability and readiness and help them choose from insourcing options:

- Achieve full migration of data and systems

- Achieve partial migration of systems and data migration and integration

- Manage data integration and connectivity for lending business.

Outcomes

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchDeliver personalization via report automation

Client

A leading asset management firm based in the U.S.

Goal

Help asset managers deliver personalized solutions to establish differentiation.

Tools and technologies

AquaData Studio, Java, Perl, Python, Spring, Hibernate, VRS, PostgreSQL, Composite and MS SQL.

BUSINESS CHALLENGE

- Its front, mid and back office functions needed a lot of manual effort

- Business rules were inconsistent and data duplication was rampant

- User experience on the platform needed significant improvement

- Clients were unable to get a holistic view of their accounts

- Data validation was consuming a lot of manhours

SOLUTION

- Our team streamlined and integrated the client’s front, middle and back office functions. We helped the client integrate their back-office solutions with their custodians, reducing complexity in information exchange, eliminating reconciliation and increasing operational efficiency by more than 75%.

- We automated the creation of more than 7,000 reports.

- Improved experience for retail and institutional clients by automating the generation of complex compliance and strategic reports.

- Developed a strategic reporting module that gave customers a holistic view of their accounts and holdings.

- Set up a business data validation team offshore.

- Enabled self-service option for bespoke reports.

OUTCOMES

- Automated the exhibits process with 75% increase in throughput

- Our report automation solution reduced manual effort by 70% and improved monthly artefact generation throughput by 40%

- Reduced manual effort for customization in client profile management by 60%

- Achieved $50,000 savings monthly in data validation for client profile management

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchSetting a high standard for member experience

Client

One of the world’s leading retail standards organizations.

Goal

Build a 24x7 cloud-based platform capable of storing and sharing data on billions of products.

Tools and technologies

Java, Python, NodeJS, .NET, Azure PostgreSQL, Azure SQL, MongoDB, Redis, Azure DevOps, Pipelines, Git, Docker, Kubernetes and Azure App Service.

BUSINESS CHALLENGE

Our client is a global standards organization. Its products and codes are used by millions of brand owners, retailers and supply chain partners around the world.

The organization needed an always-on, scalable cloud-based platform capable of storing and sharing data on billions of products and related information with members and partners across the world.

The client also wanted the ability to onboard member organizations quickly and seamlessly.

They wanted the business capabilities developed on a platform to be available as modern and secure enterprise-level APIs.

SOLUTION

We chose a microservices architecture for high agility, loose coupling, independent deployability and maintainability.

We followed an API design-first approach and designed according to the standards-based API specification (OpenAPI Specification).

In line with best practices for securely publishing and maintaining APIs, our team deployed the Azure API management solution. We used Azure APIM developer portal to deliver a superior developer onboarding experience. The solution had other features as well:

- Design and implementation of the Azure Virtual network for securely hosting the platform.

- A cloud-native architecture using the Azure AppService and an Azure-managed Kubernetes platform.

- Comprehensive performance testing and optimization at all levels to meet strict SLAs.

- Security testing and vulnerability assessment to ensure secure APIs.

OUTCOMES

- A robust and secure API platform that handles 200,000 API requests per day

- 50 million codes uploaded in 40 product categories across more than 130 countries

- Delivered a developer portal for quick onboarding of application developers

- New 7-step verification mechanism led to the creation of new revenue streams

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAn API ecosystem expedites customer onboarding

Client

The client is a leading logistics and transportation services provider, ranked among the top 10 in the world.

Goal

Rapid onboarding of partners and customers; improve customer experience.

Tools and technologies

Azure, Dell Boomi APIM and oAuth 2.

BUSINESS CHALLENGE

The growing volume of business required the client to respond faster to market demands. On their current systems, it was a challenge for the support staff to onboard new clients and service their requests.

The client needed a solution that would help it respond quickly to diverse business needs, including:

- Last mile shipment tracking and alerts across carrier networks

- Quotes for multiple shipment options

- Special fulfilment orders

- Order personalization for seasonal surges

SOLUTION

We proposed and developed a comprehensive API layer that allowed customers and partners to access client systems using APIs.

Customers and partners could easily track shipments and get quotes on their own. This reduced the need for support personnel to service routine requests. The team configured these APIs on Boomi’s API Management to enable seamless real-time integration.

OUTCOMES

- Improved onboarding speed: 20+ partners per month

- Enabled client to handle large volumes of requests, with a service capacity of 35,000 API requests a day

- Improved customer experience through real-time rates and quotes

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchStriking the right balance of care

Client

A leading provider of work-life services to caregivers.

Goal

Enable caregivers to easily set up and manage care schedules.

Tools and technologies

HTML, CSS, JavaScript, Bootstrap, JQuery, Atlassian User Interface (AUI), AngularJS and Liferay DXP7.2

BUSINESS CHALLENGE

Many young and middle-aged workers combine both work and caregiving responsibilities that cover not only children but extend to parents and pets. Research shows that employees who achieve greater work-family balance are more satisfied in their jobs and happier with their families.

For our client, a leading provider of work-life services, the key to enabling that balance is the setting up of care schedules for dependent or vulnerable family members. The client’s existing solution for managing such schedules, however, was not user-friendly, flexible, or mobile-responsive.

The client's websites offered no provision to schedule premium services for care.

The websites were served by a Liferay V6.2 content management system (CMS) as the common backend for which support ended in December 2020.

SOLUTION

We designed and developed a web platform for scheduling care for family members including parents, children, self and pets, with e-mail notifications and quick access to customer care. We migrated the websites to Liferay DXP7.2 CMS backend.

To improve the performance of the web application, we developed website forms as AngularJS-based single-page applications. We developed a responsive website that worked flawlessly across different-sized screens on desktops, tablets and mobile phones.

We used Agile methodologies right from the requirements-gathering phase until the final deployment of the web platform to shorten development time.

To save cost and time, we used an almost identical codebase for both iOS and Android platforms (except for a few configuration settings and device specific features).

Furthermore, our team performed continuous integration using automated build tools, and script and code repositories, to save time during the development, testing and deployment phases.

We ensured that the sites we built followed the WCAG 2.0 and OWASP accessibility and security standards.

OUTCOMES

- The web platform we developed ensured the client’s care scheduling interface was user-friendly, flexible and mobile-responsive.

- Customers could easily create, change and cancel schedules. They also had easy access to records and historical data.

- The common codebase across iOS and Android ensured significant cost savings in the development and maintenance of the application.

- Agile methodologies and a high degree of automation reduced costs and shortened the development time.

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchA robust platform for investment advisors

Client

A leading brokerage and wealth management firm based in the U.S.

Goal

Create a best-in-class platform for registered investment advisors (RIAs).

Tools and technologies

Pivotal Cloud Foundry, Spring Boot, Spring Cloud Gateway, Angular 6, TIBCO AMX BW, SQL Server, Hybrid Automation Framework (Selenium, Appium, Perfecto) and AppDynamics

BUSINESS CHALLENGE

With growing competition from nimble fintechs, custodians are under pressure to provide RIAs a differentiated experience. Many of them are looking to use advanced technology solutions such as machine learning, artificial intelligence and data and analytics to help RIAs improve the end consumer experience.

Our client had multiple legacy platforms built over the years that was preventing it from providing their RIAs with a secure, integrated and cost-effective solution.

SOLUTION

Iris has been played an integral role in transforming the client’s technology landscape from a legacy system to a modern, open, API-based architecture. The solutions we have implemented include:

- An open access platform with API architecture as part of the client’s go-to-market strategy. We continue to work on integrating third party vendor applications and RIA back-office applications onto this platform.

- The platform is highly reliable and secure with protection of data at rest and in motion using encryption. We have enabled encryption of data in transit to protect over 100+ integrations outside the client environment. We have used SAML and OAuth for user authentication.

- An SSO solution provides multi-factor authentication (MFA) and a framework for privileged access management to secure customer information. The Iris team has also ensured mobile security for iOS & Android devices and helped the client plug platform vulnerabilities.

- Developed responsive design as part of the UI transformation initiatives for core trading, advisory and educational solutions.

- Transformed monolithic application into micro services-based architecture.

- Provided flexible development capabilities with distributed Agile teams and extensive test automation reducing time to market and achieving significant cost savings.

- Digitized end-to-end client onboarding with features for bulk onboarding, advisor authorization and ability to submit statutory documentation online and offline.

- Created back-office solutions for money movement and cash and asset management that allowed RIAs to get a holistic view of clients and serve them on the go.

- Customizable workflow to serve needs of individual advisor firms.

OUTCOMES

Related Stories

Advanced App Engineering transforms broker bank data

New, end-to-end application for managing brokers’ compensation details ensures accuracy and efficiency.

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchGain speed to market with DevOps solutions

Client

The client is a leading wealth management firm in the U.S.

Goal

DevOps strategy to shorten production timelines and speed time-to-market.

Tools and technologies

JIRA, Jenkins, GitHub, AWS, ECR, Docker, EKS and Helm.

BUSINESS CHALLENGE

The client used multiple legacy applications with a highly complex codebase to run its operations. As a result, it had long production lifecycles and spent several person-hours in integration and deployment.

On the technology front, the client faced challenges in the way server-side applications were defined, stored and managed. Its IT team also had to manage the deployment of multiple Kubernetes manifest files.

SOLUTION

Iris recommended that the client move to a microservices ecosystem. Here’s how we deployed the solution:

- We defined an enterprise-level DevOps strategy using Helm

- Identified the scope of apps that needed to be on-boarded across the enterprise

- Implemented a DevOps pipeline for microservices on the Kubernetes cluster

- Deployed the infrastructure, dependencies and applications with Kubernetes using Helm

- Delivered continuous improvement through Helm release updates and rollbacks

OUTCOMES

The DevOps pipeline significantly improved time-to-market for new releases.

- 20x faster release cycle

- 40% improvement in quality with end-to-end traceability

- 15x improvement in the mean time to deployment (MTTD)

We also put in place robust security control and validation processes; and provided for auditable release requests.

Related Stories

Strengthening Product Data Management

Transforming product data management with a secure, governed platform designed for resilience and efficiency.

Modernizing Product Data for Future Growth

Learn how Iris Software modernized legacy product data with Azure Databricks, ensuring secure, governed, and scalable enterprise data access.

API integration secures news feed portal

Scalable AWS-based solution delivering financial news with secure API, role-based SSO, and consistent user experience.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAnti-money laundering: managing regulatory risks

Client

A leading global bank with operations in over 100 countries

Goal

Address data quality and cost challenges of legacy AML application infrastructure

Tools and technologies

Hadoop, Hive, Talend, Kafka, Spark, ETL

BUSINESS CHALLENGE

The client’s legacy AML application infrastructure was leading to data acquisition, quality assurance, data processing, AML rules management and reporting challenges. High data volume and rules-based algorithms were generating high numbers of false positives. Multiple instances of legacy vendor platforms were also adding to cost and complexity.

SOLUTION

Iris developed and implemented multiple AML Trade Surveillance applications and Big Data capabilities. The team designed a centralized data hub with Cloudera Hadoop for AML business processes and migrated application data to the big data analytical platform in the client’s private cloud. Switching from a rule-based approach to algorithmic analytical models, we incorporated a data lake with logical layers and developed a metadata-driven data quality monitoring solution. We enabled the support for AML model development, execution and testing/validation, and integration with case management. Our data experts also deployed a custom metadata management tool and UI to manage data quality. Data visualization and dashboards were implemented for alerts, monitoring performance, and tracking money laundering activities.

OUTCOMES

The implemented solution delivered tangible outcomes, including:

- Centralized data hub capable of handling 100+ PB of data and ~5,000 users across 18 regional hubs for several countries

- Ingestion of 30+ million transactions per day from different sources

- Greater insights with scanning of 1.5+ Billion transactions every month

- False positives reduced by over 30%

- AML data storage cost reduced to <10 cents per GB per year

- Extended support to multiple countries and business lines across six global regions; legacy instances reduced from 30+ to <10

Related Stories

API integration secures news feed portal

Scalable AWS-based solution delivering financial news with secure API, role-based SSO, and consistent user experience.

Unified platform automates investment deal data

A next-gen platform delivering faster performance, cost savings, and real-time reporting for deal and issuer data.

Reliable Data Governance at Scale

Structured workflows and automation enhanced governance, enabling reliable data quality, scalability, and confident regulatory compliance.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchIndia’s No 2 HR Influencer, Sharad Verma, reflects upon technology, behavior and the Future of Work

Recently named India’s no. 2 HR Influencer by SHRM (Society for Human Resource Management), Sharad Verma is Iris India’s VP and CHRO, leading Human Resources for the company. A graduate of XLRI Jamshedpur, Sharad spent his entire career in HR. He joins Iris after being the HR Head at Polaris Consulting and Sears Holding.

Even though he has 30,000 followers on LinkedIn and close to 15,000 followers on Twitter, Sharad does not see himself as an ‘influencer.' “I started a blog to share my thoughts on HR but I also wrote pieces around mindfulness and special interviews such as the Facebook workplace. Another piece called ‘talent hacker’ also got a lot of traction. The blog morphed and now reflects a cross section between technology and behavior.”

HR is getting complicated with many specializations such as recruitment, rewards, training, etc. What do they mean and how do they fit together?

There is a lot that HR has to achieve between leadership, capabilities, strategy, retaining, competencies, rewards and culture. Some of it is quantifiable and measurable but much of it is not. Some, like culture, is palatable and you can see it. As I have had opportunities to do many ‘hands-on’ HR tasks either individually or as part of the whole, it gave me a wholesome ‘HR function’ perspective for an organization. My approach, which has been deliberate, has helped me understand the complete picture by working alongside business leaders to achieve both, people and business goals.

You were acknowledged as India’s 2nd biggest influencer by the recent SHRM report. That is a pretty big deal, considering India has close to 1 million HR professionals. What does the acknowledgement mean?

I have always been passionate about Twitter, seeing it less as a social media platform and more as a medium of expression. Traditional HR is more about process and policy. Influence, on the other hand is about how to influence another’s opinion, discovering your key message, what you stand for and building an audience around it to create a brand for yourself and for your company. I write about data, analytics and HR, with a focus on how technology is affecting HR today. The confluence of both is a really interesting space. A recent study by Stanford Labs, for example, talked about how to change behavior in small bites; I now apply it at Iris as well as share it in my writings.

Tell us more about this intersection of data, analytics and HR. How does HR interact with data today and why is it important?

My starting point has always been the insights that come from the intersection of capabilities, technology and data. When I joined, I conducted values workshops to discover what values were important to Iris. What is strong in our DNA? What do we live on, on a daily basis? What would we like to change? The results? Client delight came out as a consistent factor with a natural desire amongst team members to understand and be curious about clients to see them happy. Empathy and people-touch were also strong. The empathy part being intentional and upfront was a pleasant surprise, as many companies hope that it comes up but is usually difficult to preserve as a value. As the future of work continues to morph, empathy will continue to be key.

Iris is a good company; it takes care of clients and employees. The challenge is to continue growing while preserving our strong culture. We are, therefore, focusing on the three pillars of process, technology and policy. We will be investing in an HR management system because without the proper tools one cannot achieve what we have set out to do, no matter how good the intention.

At the end of the day, business is about people, especially at Iris. It is therefore important to understand how to unleash the creative function of the employees, so that they, in turn, can expand the client portfolios that they manage. It is important for HR to understand the whole picture along with the business value; otherwise it only adds value from a functional perspective. My belief has always been business value first and function next.

The Future of Work is changing. In that context, where is HR heading?

HR as a function has become more agile. The data from simple metrics such as ‘Where are we hiring from?’ ‘What is our success rate?’ ‘Did they join or not join?’ ‘What are the drivers to stay?’ and so forth, can help us do some predictive analytics. For example, data showed us that engaged teams + collaborative colleagues + exciting work = higher retention. We found out that we need to do some more work around coaching and mentoring and that a 3-month feedback cycle may be more effective than a 1-year feedback cycle. We also found out that appreciation may mean different things to different people. In this and many other ways, data generated from HR can be used to drive strategy.

Do you have any advice for young HR professionals graduating now?

Human Resources, at the end of the day, should be about people. Ask yourself if you are genuinely interested in people and be naturally curious in them, rather than in excel sheets. As AI takes over several functions in an organization, the ‘human’ side of business will become even more important. Secondly, HR is more interesting when you are interested in more than its traditional boundaries. I urge students to see it as the key to understanding companies and businesses by not constraining yourself to the traditional HR boundaries.

Any advice for Iris team members?

The great thing about Iris is the close partnership between the 3 founders. I have had in-depth individual interactions with all 3 and each meeting has been really inspiring. Business is about people, especially at Iris, which, as I mentioned earlier, is very customer and people focused. It is therefore important to keep that Iris DNA of small teams and committed team members while we continue to grow at the exponential rate that we have for the past few years. I am excited to be part of that journey and taking it to the next level.

“As AI takes over several functions in an organization, the ‘human’ side of business will become even more important” – Sharad Verma, VP and CHRO, Iris

What gets Sharad out of bed every day?

The prospect of being a life-long student with the advantage of indulging my creative side is an exciting proposition. “I see myself as a little bit of an artist and a writer, with an effort to bring that side into the corporate world. It is important to keep that side of me alive in what would normally have been a rather straight jacketed job.”

Follow Sharad Verma on Twitter @isharad

SMHR’s recent Influencer report for 2019 can be accessed at: https://www.shrm.org/shrm-india/Documents/HR%20Report2019.pdf

About Iris

Iris Software is a professional software services organization serving customers in the USA, Canada and India for over 25 years. Iris focusses on developing ready-to-deploy Custom-Off-The-Shelf solutions, Application Software development services, as well as services towards the maintenance, testing, integration and support of software.

Iris services the information technology requirements of companies ranging from the Fortune 100 to medium-sized firms by utilizing specialized domain knowledge, best-of-breed technologies, rapidly deployable proprietary frameworks/solutions and flexible engagement models. Iris provides thought leadership to solve business problems creatively by conceptualizing and delivering uncommon solutions, leveraging existing technologies and new computing paradigms such as Digital Transformation, ML, Analytics and Insights, Cloud Computing and Process Automation. Iris continually innovates to accelerate outcomes such as time-to-market, lower costs, ease of maintenance and reduced Total Cost of Ownership (TCO). Iris’s core strengths of software engineering best practices enables it to deliver high-quality solutions consistently.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchIndustries

Company