Client

An educational testing and assessment organization

Goal

To develop a system that monitors business operations and provides key metrics to assess the impact of pipeline disruptions

Tools and Technologies

NOT LISTED SEPARATELY

Business Challenge

The client required a system to monitor the operations pipeline and provide a high-level overview of critical data and metrics related to test delivery and assessment. The solution needed to track registration and scoring results while also helping evaluate the potential business and financial impact of outages or disruptions.

Solution

- Developed a Business Operations Support System (BOSS) with executive and operational dashboards

- Enabled timely and accurate tracking of registration and scoring results for reporting

- Proactively monitored the operations pipeline for SLA and OLA compliance, with alerts for exceptions

- Built an operational platform to support multiple programs and act as a centralized data repository

Outcomes

- Enhanced visibility into monitoring across individual programs and domains

- Established the foundation for analytics, machine learning, automation, and intelligent forecasting in internal assessments

- Provided actionable inputs for evaluating the business and financial impact of test volumes

Our experts can help you find the right solutions to meet your needs.

Developing a robust performance testing solution

Client

Leading health coaching organization with a global network

Goal

To ensure automated performance testing for SLAs using a cloud-based system with near 100% reliability on new architecture

Tools and Technologies

JMeter, Datadog, AWS API Management, Dockers orchestrated with Kubernetes, Azure CDN

Business Challenge

The client’s LMS and certification applications, built on a microservices-based architecture, required robust performance testing. Existing solutions struggled with encryption of APIs, varying network bandwidths, multi-region responses, and other critical parameters.

The goal was to create a cloud-based performance testing framework that could meet predefined SLAs, eliminate bottlenecks, ensure cost efficiency, and deliver near 100% reliability.

Solution

- Defined performance goals and identified bottlenecks

- Developed performance scripts using JMeter

- Ran bulk user load tests from three load generator machines using JMeter distributed load model

- Validated transactions across downstream applications through:

- Load tests with an incremental and iterative approach

- Various network simulation techniques

- Monitored load tests using Datadog APM

- Developed a need-based spin-up of performance environment

Outcomes

- Created 47 API test scripts using complex custom bean shell sampler and post processer

- Executed 30+ test cycles covering load, stress, scalability, endurance, spikes

- Identified nine critical performance bottlenecks including:

Middleware (API connector)

Database performance (mainly with indexes and orphan views)

Automated shift left performance testing and integrated DevOps

- Ensured cost efficiency with optimized AWS ecosystem

Enhanced overall system reliability from 73% to near 100

Our experts can help you find the right solutions to meet your needs.

Building a smart business catalog with faster discovery

Client

An educational testing and assessment organization

Goal

To build and leverage a business catalog as a cost-effective solution for smart, user-specific output across varied datasets

Tools and Technologies

NOT LISTED SEPARATELY

Business Challenge

The client needed a business catalog to enable faster discovery and better understanding of datasets in a cost-effective manner, while also generating user-specific outputs for authorized individuals. The initiative began as a pilot using a select set of data sources.

Solution

- Leveraged existing AWS Data Lake and Glue catalog for extended use

- Integrated native S3 and Redshift with the catalog

- Implemented pre-defined Glue data quality rules reporting for assets to generate a trust index before subscription

- Enhanced search and discovery with AI-generated asset metadata and summaries

- Enabled seamless authentication and authorization through SSO integration

- Automated workflow-based data access management, with human intervention only at approval stage

- Designed REST API-driven onboarding process

Outcomes

- Enabled discovery of new datasets through search and subscription

- Simplified access to reliable datasets, enhancing data science and BI for generating insights

- Established a compliance framework aligned with organizational standards

- Accelerated and improved decision making through access to trusted data

Our experts can help you find the right solutions to meet your needs.

Streamlining an enterprise payment management system

Client

An educational testing and assessment organization

Goal

To streamline gateway and acquirer services in a single system to reduce costs, boost service and enable wider integration

Tools and Technologies

NOT LISTED SEPARATELY

Business Challenge

The client needed to standardize all credit card and e-payment processes by replacing custom-developed and externally hosted gateways with a merchant-configurable system. The aim was to consolidate gateway and acquirer services under a single vendor to reduce costs, improve service levels, and enable future integration with SaaS or open-source e-commerce solutions.

Solution

- Created a centralized set of payment collection and processing pages for all e-commerce applications

- Ensured PCI compliance at an enterprise level

- Integrated and streamlined system reconciliation processes

- Designed the system for future integration with SaaS or open-source e-commerce platforms

Outcomes

- Delivered updated and user-friendly validation messages

- Implemented robust logging, error handling, and real-time status updates for transactions

- Deployed a postback system to capture responses, validate outcomes, update registration statuses, and send error reports via email

- Enabled future API development for a fully functional service/connection

- Reduced costs by eliminating external payment gateway hosting and development fees

Our experts can help you find the right solutions to meet your needs.

The AI Leap: Navigating Early Adoption Towards Scalable Success

From GenAI pilots to enterprise-wide adoption, how organizations can move beyond experiments and unlock measurable value.

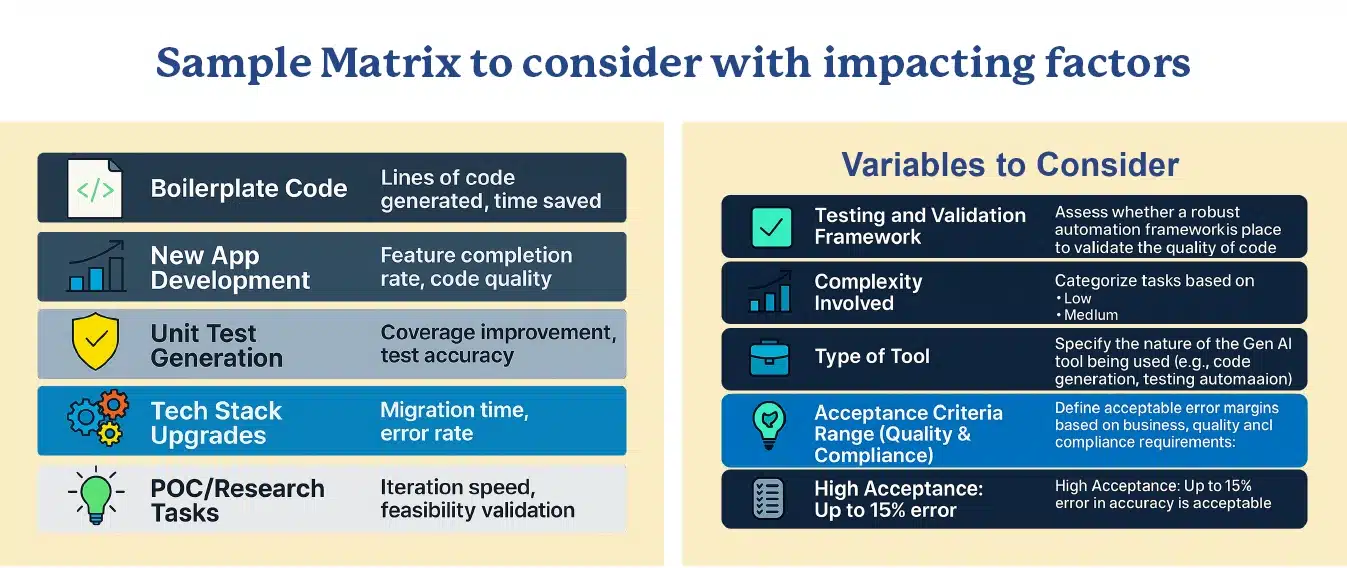

AI is no longer a futuristic concept — it’s reshaping how businesses operate today. But while GenAI has proven its potential to accelerate coding, streamline processes, and improve decision-making, most organizations are still in the early stages of adoption.

Challenges like quantifying ROI, ensuring compliance, and integrating AI into existing systems are holding enterprises back. With only 1% of organizations calling themselves “mature” in AI adoption, the leap from pilot to scale is the real test.

Read our Perspective Paper for a detailed playbook on the AI adoption journey, from early experimentation to enterprise-scale success, complete with key phases, measurable benefits, and a real-world case study.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchBuilding a sustainable and scalable evaluation network

Client

A major educational testing and assessment organization

Goal

To build a sustainable and scalable evaluation solution for varied scoring systems across millions of constructed responses

Tools and Technologies

AWS CloudFront, AWS CloudWatch, Lamda, Amazon EndPoint, AWS, and Twilio

Business Challenge

The client needed a sustainable and scalable system to manage the evaluation of millions of constructed responses (CRs) annually through distributed or in-person scoring.

The goal was to develop streamlined processes, standardized reporting features, and secure, role-based access, as well as admin modules for monitoring.

Solution

Developed an online network for evaluation with enhanced capabilities for sample selection, training, monitoring, scoring and reporting, like:

- Streamlined reports to facilitate online communications and rater mentoring

- Secure, role-based access with appropriate restrictions for system functions

- Admin modules for broadcast, central documentation and communications

- Facilities for monitoring, broadcast, search and other tasks

- Multi-media modes for scoring

- Monitoring for ratings, reviews and other activities as required

Outcomes

- Ensured robust scheduling and integrated forecasting to project rater demand

- Enabled configurable role-based permissions to specific scoring and administrative functions

- Established program hierarchy setup with specific scoring/scheduling needs

- Created user-friendly interface with role specific navigation

- Developed direct tie to IBIS item bank for multiple functions

- Provided real-time, tier 2 support for active test evaluators

- Minimized downtime to avoid extending billable hours for evaluators

Our experts can help you find the right solutions to meet your needs.

Developing an automated, agnostic test framework

Client

Global health coaching and certification organization

Goal

To develop a test automation framework core across multiple applications with consolidated tableau dashboards for reporting

Tools and Technologies

Selenium, Java, REST Assured, Azure API Management, Docker, Tableau, Jira, Git

Business Challenge

The client used a technology stack comprising different applications without employing automated testing. This resulted in scattered reporting across the stack and made it difficult to validate end-to-end business flows. Rigorous testing was required to ensure quality, security, and compliance.

The aim was to develop a core test automation framework with common utilities and support for UI, API, mobile and Salesforce applications and consolidated Tableau dashboards for reporting and greater efficiency, security and compliance.

Solution

- Developed an in-house agnostic test framework (core) to support UI, API, mobile and Salesforce applications

- Built common utilities in core framework for enterprise and application layers

- Ensured parallel and cross browser testing, flaky tests handling and inbuilt retry logic

- Identified E2E business flows to validate downstream impact

- Implemented a lightweight test automation ecosystem

- Integrated DevOps using AWS

- Leveraged Selenium for script development

Outcomes

- Developed a common framework to support all applications

- Covered 628 business requirements and created/executed 7,689 test cases

- Delivered a 25x faster release cycle that required minimal maintenance

- Speed up script development by 4x

- Automated ~95% of coverage

- Enhanced efficiency in reporting through consolidated tableau dashboards

Our experts can help you find the right solutions to meet your needs.

Scalable platform for learning and engagement boosters

Client

A global health coaching and certification organization

Goal

Re-architect the existing platform, improve user experience and boost student engagement, retention, and graduation rates

Tools and Technologies

AWS CloudFront, AWS CloudWatch, Lamda, Amazon EndPoint, AWS, Twilio

Business Challenge

The client used a legacy monolith learning platform served from multiple LMS that required multiple logins. Adding new features took significant effort and risked disrupting existing ones.

The system experienced substantial downtime at periods of peak load, leading to poor user experience, lower graduation rates, and revenue loss.

The goal was to modernize the technology platform and reduce manual intervention to achieve 99.99% uptime.

Solution

- Re-architected the technology platform using microservices and an event-driven architecture

- Redesigned the user experience and engagement models

- Reduced manual intervention

- Automated scheduling, payment and scoring for tests

Outcomes

- Achieved 99.99% uptime on new platform

- Delivered a unified learning experience to students across multiple LMS platforms

- Increased student engagement with learning content by over 70%

- Cut operations-related effort by more than 50%

Our experts can help you find the right solutions to meet your needs.

Developing a unified platform for educational testing

Client

A major educational testing and assessment organization

Goal

To develop a comprehensive, secure test delivery and management platform with customizable UI and multi-device compatibility

Tools and Technologies

AWS Cloud Solutions

Business Challenge

The client wanted to develop a comprehensive platform for test delivery and management to replace outdated Java-based systems with one built on modern standards.

The goal was to streamline processes by integrating various components and functionalities and develop a test delivery engine which would support high-stakes exams. The solution also needed to offer customizable user interfaces and compatibility with multiple devices.

Solution

- Hosted and delivered tests using AWS cloud solutions and installers for local servers, admin stations, verification tools, and more

- Developed multiple delivery solutions including secure browser-based tests for testing centers and non-secure browser tests for home use

- Supported remote proctoring solutions for TOEFL, GRE, CLEP, and others

- Enabled special accessibility features for persons with disabilities

- Used native code to detect virtual key and mouse events to ensure security and compliance with ADA

Outcomes

- Simplified the test-taking experience by consolidating proctoring and assessment processes into a single secure browser

- Modernized user interface using contemporary HTML5 standards

- Developed features for persons with disabilities such as keyboard accessibility and screen reader support

- Delivered compliance with ADA

- Enabled configurable branding

Our experts can help you find the right solutions to meet your needs.

Self-serve platform for BI reports with QA, governance

Client

A major educational testing and assessment organization

Goal

To rationalize and modernize the system for BI reports and deliver a better UX with quality assurance at a reduced cost

Tools and Technologies

Power BI, Semantic Modelling, MSBI

Business Challenge

The client had a current set of 400+ Power BI and 600+ SSRS reports. A number of these were obsolete and had to be removed and archived.

Users faced multiple challenges that had to be identified by collating feedback so that appropriate solutions could be developed. The aim was to modernize and rationalize the system to achieve better governance and reduce costs of infra and support services.

Solution

- Collated user feedback to pinpoint key challenges and improvement areas

- Identified, removed and archived many obsolete and orphaned reports

- Built a holistic semantic model to support reports with self-serve BI capability

- Introduced new, rationalized, and interactive reports/dashboards

- Enhanced UI/UX design with a provision to introduce branding

- Developed a robust process for data governance and quality assurance

- Created extensive documentation to enable complete user self-serve capabilities

- Trained users on BI self-serve

Outcomes

- Achieved 80% reduction in the number of reports post-rationalization

- Ensured 60% reduction in requests/enquiries for data by making it readily available through documentation

- Delivered 60% to 80% reduction in time required to build new custom reports

- Enhanced user confidence in data generated

- Increased number of users and per report user views

Our experts can help you find the right solutions to meet your needs.

Industries

Company