Client

Leading supply chain brokerage

Goal

Automate the manual, supply-chain scheduling process to improve staff productivity and customer satisfaction

Tools and Technologies

UI Path Orchestrator, UI Path Assistant, Microsoft Power BI, Office 365

Business Challenge

Performing crucial supply chain logistics, a provider’s operations team was struggling due to the high volume of scheduling appointments with shippers, receivers, and carriers, which involve back and forth emails, phone calls, or manual data entry into multiple Transport Management Systems (TMS).

These appointment-scheduling complexities vary based on the parties involved, from sending an email requesting appointment times to accessing a TMS and selecting what’s available as per their schedule.

Lacking proper analytics, sales representatives were unable to pinpoint peak appointment times, track cancellation rates, or discern customer preferences, often leading to shipment delays and incurred detention charges.

Solution

- Deployed multiple rule-based, automated workflows to pull information from incoming appointment requests (from emails, web forms, etc.) and automatically input it into the various TMS used to book pick-up and delivery appointments

- Developed a Power BI dashboard to visualize appointment trends, peak times, and cancellation rates, providing insights into customer behaviors, including frequent reschedules, preferred times, and typical lead times for booking appointments

- Delivered a reusable solution that could be leveraged for other business areas

Outcomes

- Bots operating 24/7 have led to over 15,000 monthly appointments being scheduled, resulting in a 50% reduction in manual scheduling hours

- The productivity of the operations team has improved by 50%, enabling staff to concentrate on high-value tasks rather than manual appointment-booking

- The increased accuracy in scheduled appointments has significantly decreased detention charges, thereby boosting overall customer satisfaction

Our experts can help you find the right solutions to meet your needs.

Automated POD improves turnaround time 95%

Client

Leading supply chain brokerage

Goal

Automate Proof of Delivery documentation process to increase efficiency and accuracy in data upload, validation and invoicing

Tools and Technologies

UI Path Orchestrator, UI Path Document Understanding, Microsoft Power BI, Oracle Transportation Management

Business Challenge

Proof of Delivery (POD) is a document that confirms an order has arrived at its destination and was successfully delivered before the invoice can be billed for payment.

Lack of an electronic POD system leads to inefficient, manual processing due to varied legal and contractual documentation requirements, resulting in longer billing cycles. Diverse formats and layouts from different carriers complicate data extraction from paper-based PODs.

Solution

- Developed a Document Processing Bot with UI Path AI Center, leveraging Document Understanding and Optical Character Recognition for managing various carrier documents

- Optimized data models for major carriers, focusing on the top five document types that represent 80% of the volume

- Implemented UI Path Action Center's "Human in the Loop" to handle exceptions and conducted 6-8 weeks of rigorous training on the Document Understanding model to ensure accuracy and meet confidence targets

Outcomes

- Achieved a 95% reduction in POD turnaround time, dropping from 48 hours to 2 hours, significantly boosting customer satisfaction

- Enhanced productivity by 87.5%, confirming receipt and condition of freight efficiently

- Reached 80% process accuracy, with continuous enhancement via automatic retraining

- Cut the billing cycle by 35%, allowing immediate use of data for customer invoicing

Our experts can help you find the right solutions to meet your needs.

Unified automation strategy enhances efficiency

Client

Leading payroll and HR solutions provider

Goal

Develop automation strategy and framework that accommodates growth and ensures efficiency

Tools and Technologies

Ansible, AWS, Dynatrace, Gremlin, Groovy, Jenkins, Keptn, KICS, Python, Terraform

Business Challenge

The SRE (Site Reliability Engineering) shared services team faced a diverse set of needs relating to automation of infrastructure and services provisioning, configuration, and deployment.

The team was encountering resource constraints, as limited in-house expertise in certain automation tools and technologies was causing delays in meeting critical automation requirements. They also needed to ensure system reliability and were challenged to scale automation solutions to accommodate increasing demands as operations grow.

Solution

- Development of a comprehensive automation strategy to align with objectives, encompassing Terraform, Ansible, Python, Groovy, and other relevant technologies in the AWS environment

- Leveraging our expertise to bridge the knowledge gap, provide training, and augment the client team in handling complex automation tasks

- Implementation of a chaos engineering framework using Gremlin, Dynatrace, Keptn, and EDA tools, to proactively identify weaknesses and enhance system resilience

- Creation of a scalable automation framework that accommodates growing needs and ensures long-term efficiency

Outcomes

- A unified automation strategy that streamlined processes, reduced manual effort, and enhanced overall efficiency by 30%

- The implementation of chaos engineering and self-healing practices, which increased reliability between 20% and 50%

- A reduction in manual interventions along with improved efficiency that will result in cost savings of 25% - 50%

Our experts can help you find the right solutions to meet your needs.

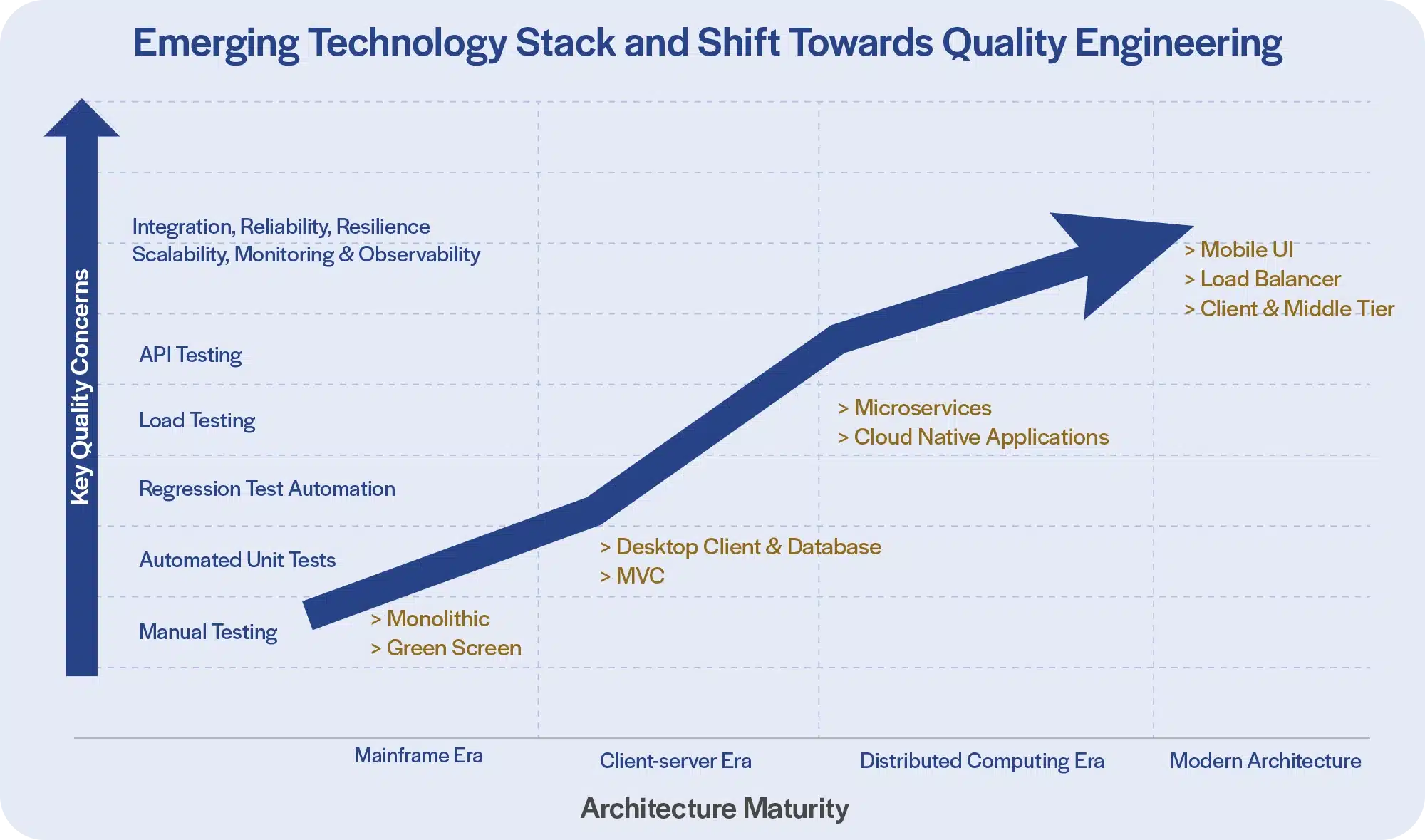

The evolution of quality engineering

Quality engineering in software development empowers organizations to achieve heightened quality, scalability and resilience.

Quality Assurance (QA) has long been essential in software engineering, ensuring the development of products and applications with established standards and metrics. But QA has been reactive, focusing on defect detection through manual and automated testing. With the evolution of software development technology and methodologies, the limitations of traditional QA are evident. This perspective paper delves into the evolution of Quality Engineering (QE), which has transformed the approach to software quality. QE goes beyond QA and Test Automation to integrate quality practices throughout the Software Development Lifecycle (SDLC); it also addresses complexities in modern architectures such as microservices and cloud environments.

The journey from QA to QE is marked by several key milestones. Initially, software testing was a separate phase, conducted after development was complete. With the advent of Agile and DevOps methodologies, the need for continuous testing and early defect detection became apparent. This shift fostered the evolution of testing practices, embedding quality checks throughout the development cycle with the emerging adoption of cloud-native modern architecture, paving the way for what is now called Quality Engineering. Unlike the reactive nature of traditional QA and QA Automation, QE represents a proactive and integrated approach throughout the development lifecycle.

Organizations can significantly enhance product or application quality, optimize development workflows, and mitigate risks by addressing QE concerns at every phase of the SDLC. They could leverage structured QE approaches as mentioned above, and focus on a holistic view of quality in modern architecture.

Read our Perspective Paper for more insights on the evolution of quality engineering in software development.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchQuality engineering optimizes a DLT platform

Client

A leading provider of financial services digitization solutions

Goal

Reliability assurance for a digital ledger technology (DLT) platform

Tools and Technologies

Kotlin, Java, Http Client, AWS, Azure, GCP, G42, OCP, AKS, EKS, Docker, Kubernetes, Helm Chart, Terraform

Business Challenge

A leader in Blockchain-based digital financial services required assurance for non-GUI (Graphic User Interface), Command Line Interface (CLI), microservices and Representational State Transfer (REST) APIs for a Digital Ledger Technology (DLT) platform, as well as platform reliability assurance on Azure, AWS services (EKS, AKS) to ensure availability, scalability, observability, monitoring and resilience (disaster recovery). It also wanted to identify capacity recommendations and any performance bottlenecks (whether impacting throughput or individual transaction latency) and required comprehensive automation coverage for older and newer product versions and management of frequent deliveries of multiple DLT product versions on a monthly basis.

Solution

- 130+ Dapps were developed and enhanced on the existing automation framework for terminal CLI and cluster utilities

- Quality engineering was streamlined with real-time dashboarding via Grafana and Prometheus

- Coverage for older and newer versions of the DLT platform was automated for smooth, frequent deliverables for confidence in releases

- The test case management tool, Xray, was implemented for transparent automation coverage

- Utilities were developed to execute a testing suite for AKS, EKS, local MAC/ Windows/ Linux cluster environments to run on a daily or as-needed basis

Outcomes

- Automation shortened release cycles from 1x/month to 1x/week; leads testing time was reduced by 80%

- Test automation coverage with 2,000 TCs was developed, with pass rate of 96% in daily runs

- Compatibility was created across AWS-EKS, Azure-AKS, Mac, Windows, Linux and local cluster

- Increased efficiency in deliverables was displayed, along with an annual $350K savings for TCMs

- An average throughput of 25 complete workflows per second was sustained

- Achieved a 95th percentile flow-completion time that should not exceed 10 seconds

Our experts can help you find the right solutions to meet your needs.

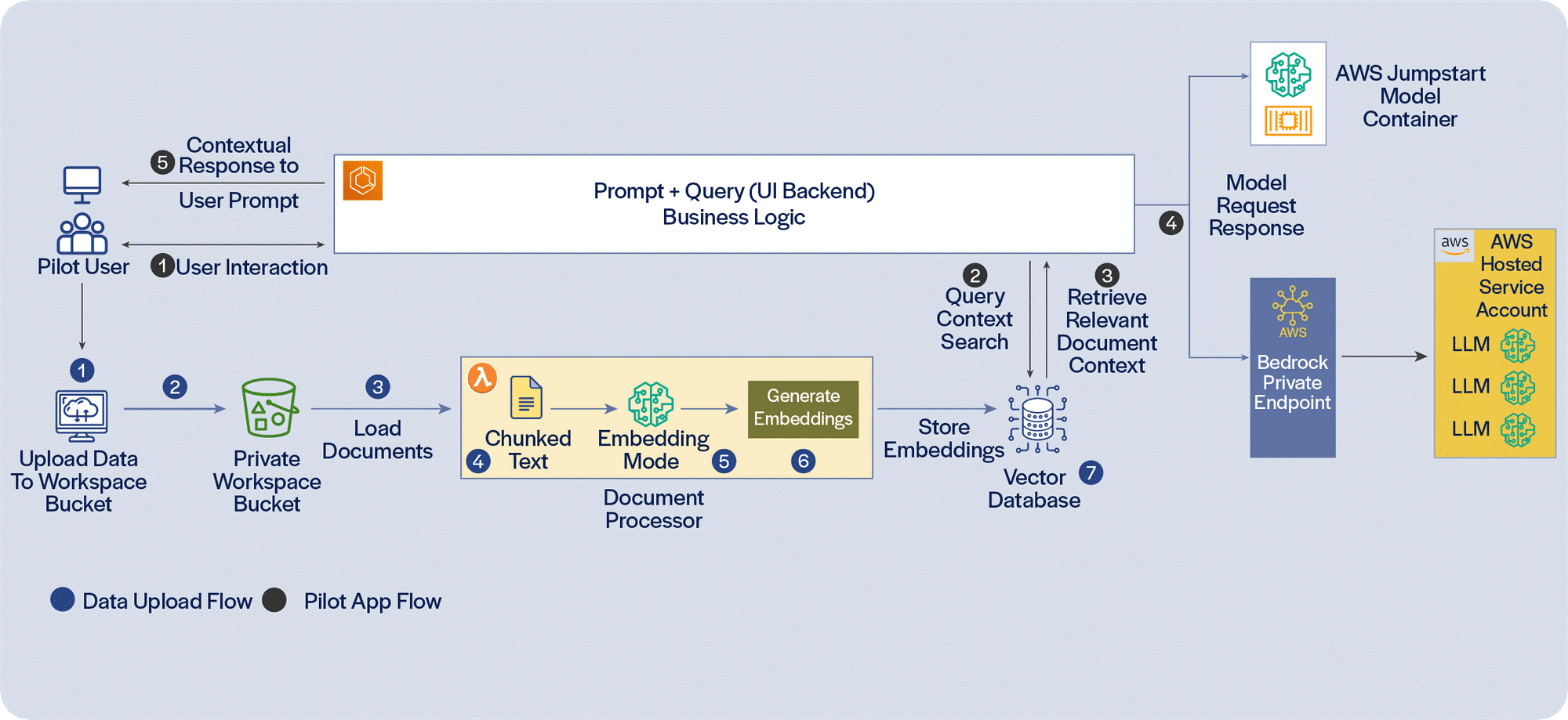

Productionizing Generative AI Pilots

Get scalable solutions and unlock insights from information siloed across an enterprise by automating data extraction, streamlining workflows, and leveraging models.

Enterprises have vast amounts of unstructured information such as onboarding documents, contracts, financial statements, customer interaction records, confluence pages, etc., with valuable information siloed across formats and systems.

Generative AI is now starting to unlock new capabilities, with vector databases and Large Language Models (LLMs) tapping into unstructured information using natural language, enabling faster insight generation and decision-making. The advent of LLMs, exemplified by the publicly-available ChatGPT, has been a game-changer for information retrieval and contextual question answering. As LLMs evolve, they’re not just limited to text. They’re becoming multi-modal, capable of interpreting charts and images. With a large number of offerings, it is very easy to develop Proofs of Concept (PoCs) and pilot applications. However, to derive meaningful value, the PoCs and pilots need to be productionized and delivered in significant scale.

PoCs/pilots deal with only the tip of the iceberg. Productionizing needs to address a lot more that does not readily meet the eye. To scale extraction and indexing information, we need to establish a pipeline that, ideally, would be driven by events, new documents generated and available, possibly through an S3 document store and SQS (Simple Queue Service), to initiate parsing of documents for metadata, chunking, creating vector embedding and persisting metadata and vector embedding to suitable persistence stores. There is a need for logging and exception-handling, notification and automated retries when the pipeline encounters issues.

While developing pilot applications using Generative AI is easy, teams need to carefully work through a number of additional considerations to take these applications to production, scale the volume of documents and the user-base, and deliver full value. It would be easier to do this across multiple RAG (Retrieval-Augmented Generation) applications, utilizing conventional NLP (Natural Language Processing) and classification techniques to direct user requests to different RAG pipelines for different queries. Implementing the capabilities required around productionizing Generative AI applications using LLMs in a phased manner will ensure that value can be scaled as the overall solution architecture and infrastructure is enhanced.

Read our perspective paper for more insights on Productionizing Generative AI Pilots.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touch

Leveraging Generative AI for asset tokenization

Enhance efficiency, security, and user experience by leveraging Generative AI in DLT-based asset tokenization.

Asset tokenization is converting ownership rights of an asset that has traditionally resided within legacy or traditional systems into a digital token on a Distributed Ledger Technology (DLT) platform. This transformation enables numerous benefits, including fractional ownership, 24/7 availability, easier transferability, and enhanced liquidity.

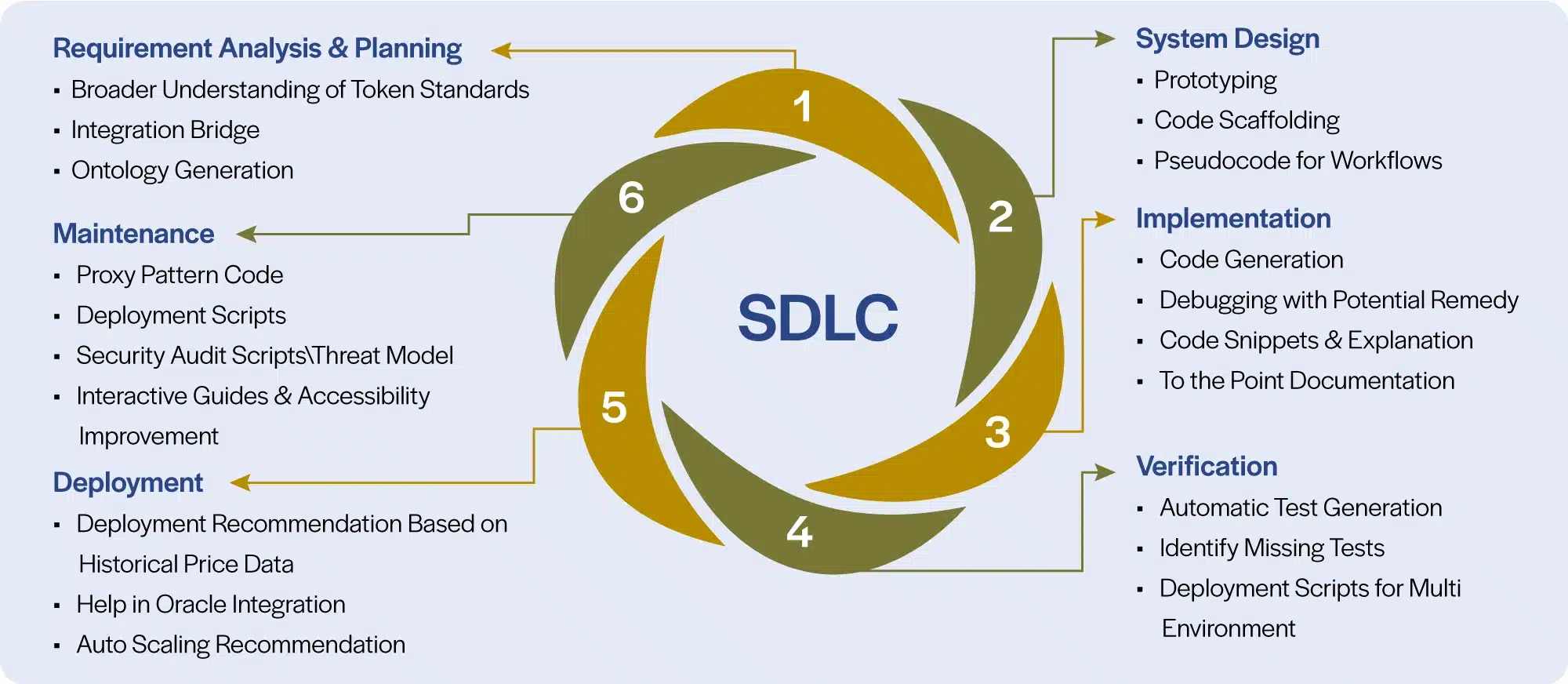

Developing and deploying a comprehensive asset tokenization system on DLT is a full-scale software development endeavor encompassing all SDLC phases. Every phase presents challenges, including technology complexities, evolving business use cases, non-standardization, scarcity of resources, and reluctance to adopt.

As asset tokenization emerges as an essential solution for financial institutions, the integration of Gen AI amplifies customer value. Institutions can achieve unprecedented efficiency, accuracy, and innovation by leveraging Gen AI's capabilities throughout the asset tokenization process.

Gen AI is set to play a pivotal role in improving asset tokenization by contributing to the different phases of its implementation. Gen AI can assist both in the implementation phase and beforehand, as it can help produce synthetic financial data that closely resembles real market conditions conduct stress tests and other simulations, helping to strengthen the platform.

Read our Perspective Paper for more insights into the key phases, benefits and the road map to asset tokenization.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchNC Tech Association Leadership Summit 2024

Iris Software will participate in the exclusive, attendance-capped, annual Leadership Summit hosted by the NC Tech Association, along with its board of directors and advisors, on August 7 & 8, 2024. Our representative, Senior Client Partner, Michel Abranches, will be among the executives gathering for the Summit, at the Pinehurst Resort in Pinehurst, NC, to network and discuss a variety of topics relevant to tech leaders and the projects and associates they manage.

The theme of this year’s summit is Adaptive Leadership. The event includes keynote addresses, executive workshops, and two panel discussions on ‘Why digital transformation is more about people than technology’ and ‘Building resilient tech teams: the power of emotional intelligence.’

As a technology provider to Fortune 500 and other leading global enterprises for more than 30 years, Iris is a trusted choice for leaders who want to realize the full potential of digital transformation. We deliver complex, mission-critical software engineering, application development, and advanced tech solutions that enhance business competitiveness and achieve key outcomes. Our agile, collaborative, right-sized teams and high-trust, high-performance, award-winning culture ensure clients enjoy top value and experience.

Contact Michel Abranches, based in our Charlotte, NC office, or visit www.irissoftware.com for details and success stories about our innovative approach and how we are leveraging the latest in AI / Gen AI / ML, Automation, Cloud, DevOps, Data Science, Enterprise Analytics, Integrations, and Quality Engineering.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touch

Real world asset tokenization can transform financial markets

Integration with Distributed Ledger Technologies is critical to realizing the full potential of tokenization.

The global financial markets create and deal in multiple asset classes, including equities, bonds, forex, derivatives, and real estate investments. Each of them constitutes a multi-trillion-dollar market. These traditional markets encounter numerous challenges in terms of time and cost which impede accessibility, fund liquidity, and operational efficiencies. Consequently, the expected free flow of capital is hindered, leading to fragmented, and occasionally limited, inclusion of investors.

In response to these challenges, today's financial services industry seeks to explore innovative avenues, leveraging advancements such as Distributed Ledger Technology (DLT). Using DLTs, it is feasible to tokenize assets, thus enabling issuance, trading, servicing and settlement digitally, not just in whole units, but also in fractions.

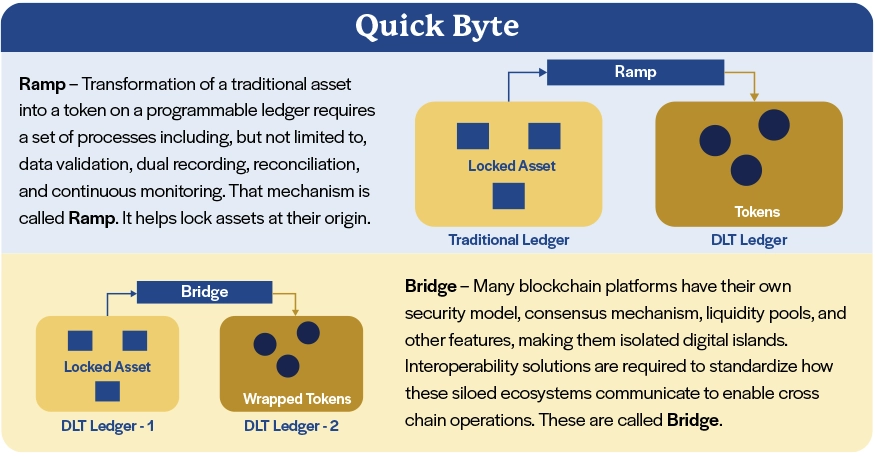

Asset tokenization is the process of converting and portraying the unique properties of a real-world asset, including ownership and rights, on a Distributed Ledger Technology (DLT) platform. Digital and physical real-world assets, such as real estate, stocks, bonds, and commodities, are depicted by tokens with distinctive symbols and cryptographic features. These tokens exhibit specific behavior as part of an executable program on a blockchain.

Many domains, especially financial institutions, have started recognizing the benefits of tokenization and begun to explore this technology. Some of the benefits are fractional ownership, increased liquidity, efficient transfer of ownership, ownership representation and programmability.

With the recent surge in the adoption of tokenization, a diverse array of platforms has emerged, paving the way for broader success, but at the same time creating fragmented islands of ledgers and related assets. As capabilities mature and adoption grows, interconnectivity and interoperability across ledgers representing different institutions issuing/servicing different assets could improve, creating a better integrated market landscape. This would be critical to realizing the promise of asset tokenization using DLT.

Read our Perspective Paper for more insights on asset tokenization and its potential to overcome the challenges, the underlying technology, successful use cases, and issues associated with implementation.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchMeet our team at the AWS Summit in NYC July 2024

Happening at the Jacob Javits Convention Center on the 10th of July, the 2024 AWS Summit New York promises more than 170 sessions on all things cloud and data - from data lake architecture, data governance, data sharing, data engineering and data streaming to machine learning (ML) and ML Ops, data warehouses, business insights and visualization, and data strategy. It also offers interaction with AWS experts, builders, customers, and AWS partners, including Iris Software. All levels of experience – from foundational and intermediate to advanced or expert - can learn and share insights on cloud migration, generative AI, data analytics, as well as industry solutions, challenges and top providers.

An Iris team with extensive and wide-ranging technology and domain experience is attending the Summit. Our professionals are ready and excited to discuss the cloud and data solutions and infrastructure modernization we provide to leading companies across many industries, as well as the advances in emerging tech that we leverage to further aid our clients’ business competitiveness, leadership and digital transformation journeys.

Our Leaders

- Vinodh Arjun, Vice President, Head of Cloud Practice

- Prem Swarup, Vice President, Head of Data & Analytics Practice

- Ravi Chodagam, Vice President, Head of Enterprise Services Sales

Financial Services Client Partners –

Brokerage & Wealth Management; Capital Markets & Investment Banking; Commercial & Corporate Banking; Compliance – Risk & AML; Retail Banking & Payments

Enterprise Services Client Partners -

Insurance, Life Sciences, Manufacturing, Pharmaceutical, Professional Services, Transportation & Logistics

Contact our team to learn more about our innovative approach and advanced technology solutions in AI / ML, Application Development, Automation, Cloud, DevOps, Data Science, Enterprise Analytics, Integrations, and Quality Engineering, which enhance security, scalability, reliability, cost-efficiency, and compliance. Explore how we can add valuable impact to harnessing and monetizing data, optimizing customer experiences, and empowering developers. For more insights, read our Perspective Papers on Cloud Migration Challenges and Solutions and Succeeding in ML Ops Journeys.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchIndustries

Company