Client

A leading multi-level marketing company

Goal

Shorten the release cycle and improve product quality

Technology Tools

Amazon CloudWatch, Elasticsearch, Bitbucket, Jenkins, Amazon ECR, Docker, and Kubernetes

Business Challenge

The client's Commercial-off-the-shelf (COTS) applications were built using substandard code branching methods, causing product quality issues. The absence of a release process and a manual integration and deployment process were elongating release cycles. Manual configuration and setup of these applications were also leading to extended downtime. Missing functional, smoke, and regression test cases were adding to the unstable development environment. The database migration process was manual, resulting in delays, data quality issues, and higher costs.

Solution

- Code branching and integration strategy for defects / hotfixes in major and minor releases

- Single-click application deployment, including environment creation, approval and deployment activities

- Global DevOps platform implementation with a launch pad for applications to onboard other countries

- Automated configuration and deployment of COTS applications and databases

- Automation suite with 90% coverage of smoke and regression test cases

- Static and dynamic analysis implementations to ensure code quality and address configuration issues

Outcomes

Automation of release cycles delivered the following benefits to the client:

- Release cycle shortened from once a month to once per week

- MTTR reduced by 6 hrs

- Downtime decreased to <4 hours from 8 hours

- Product quality and defect leakage improved by 75%

- Testing time reduced by 80%

- Reach expanded to global geographies

- Availability, scalability, and fault tolerance enhanced for microservices-based applications

Our experts can help you find the right solutions to meet your needs.

DevOps solution improves scalability by 5x

Client

North America-based fertility and genomics company

Goal

Expand business reach, reduce time-to-market, and support critical compliance

Technology Tools

.NET 5, Vue.js, AWS Secrets Manager, AWS Transfer Family, Amazon RDS, Amazon EKS, Amazon Route 53, Amazon CloudFront, Terraform, GitLab

Business Challenge

The client wanted to expand its reach to Canada, Europe, and APAC regions to meet the requirements for a 10x increase in their user base. Legacy application infrastructure and code built on the old tech stack, with high technical debt, were slowing down the rollout of new features, making the client less competitive. The infra-deployment process was only partially automated, stretching the time-to-market to three months. The total cost of ownership was relatively high. HIPPA and PII compliance were also not supported.

Solution

Iris modernized the application into microservices, built the infrastructure using Terraform and automated its provisioning and configuration.

- Application developed using .NET 5 and Vue.js

- Architecture transformed into cloud-native

- AWS Managed Services, including Secrets Manager, AWS Transfer Family, RDS, EKS, Route 53, CloudFront, and S3, configured using Terraform

- EKS Cluster and associated components provisioned via Terraform

- App pushed to container registry using GitLab pipeline

- Secrets (API keys, database connection strings, etc.) and app images moved to EKS Cluster using S3 Bucket Helm

- Static code analysis, coverage and vulnerability scans integrated to ensure code quality and reduce configuration issues

Outcomes

- Application launch in Canada and Europe; Asia Pacific release in the pipeline

- HIPPA and PII compliance

- 5x scalability improvement from weekly average usage

- Time-to-market reduced from three months to 3 weeks

- Total cost of ownership lowered by 50%

Our experts can help you find the right solutions to meet your needs.

Order management platform transformation

Client

Multinational publishing, media, and educational company

Goal

Improve order management and transaction processing capabilities

Technology Tools

AWS EKS, Kong, Salesforce Commerce Cloud (SFCC), Salesforce CRM, Jenkins, Sumo Logic, Datadog

Business Challenge

The client's order management platform was complex and had scalability issues, causing poor customer experience and loss of revenue. The platform was hosted on Oracle cloud, with data stored in different repositories. Services were also hosted in the Oracle cloud, which used the BICC extract to fetch information about order details from Oracle databases. The low performance of customer-facing applications was causing latency and very high transaction processing time.

Solution

Team Iris transformed Oracle-based SOA services into six microservices and migrated them to AWS EKS for autoscaling with self-healing and monitoring capabilities.

We developed services for publishing data to Salesforce CRM for quick order processing and conversions. The BICC system for diversified information and order history was enabled with real-time integration between Oracle Fusion and materialized views for data consumption.

Post migration, these services were registered in Kong for discovery, and a CI/CD pipeline was created for deployment using Jenkins. Sumo Logic was used for monitoring the logs, and Datadog was used to observe latency, anomalies and other metrics.

Outcomes

The order management platform transformation delivered the following benefits to the client:

- System performance improved by 70%

- Transaction processing capability increased by 4x

- Order processing capabilities were enhanced by 200%

- Total cost of ownership (TCO) was reduced by 30%

Our experts can help you find the right solutions to meet your needs.

Quality engineering for Blockchain-DLT platform

Banking & Financial Services

Next-gen Quality Engineering for Blockchain-DLT platform

Quality engineering implementation helps a digital financial services client smooth the legacy migration of its Blockchain-DLT (Digital Ledger Technology) platform by advancing automation coverage and patch delivery efficiencies.

Client

A leading digital financial services company

Goal

Blockchain- DLT platform assurance with improved automation coverage

Tools and technologies

Amazon Elastic Kubernetes Service (EKS), Azure Kubernetes Services (AKS), Docker, Terraform, Helm Charts, Microservices, Kotlin, Xray

BUSINESS CHALLENGE

The client's legacy DLT platform did not support cloud capabilities with the Blockchain-DLT tech stack. The non-GUI (Graphic User Interface) and CLI (Command Line Interface)-based platform lacked the microservices architecture and cluster resilience. The REST (Representational State Transfer) APIs-based platform did not support platform assurance validation at the backend. Automation coverage for legacy and newer versions of the products was very low. Support for delivery patches was insufficient, impacting the delivery of multiple versions of R3 products each month.

SOLUTION

Iris developed multiple CorDapps to support automation around DLT-platform functionalities and enhanced the CLI-based & cluster utilities in the existing R3 automation framework. The team implemented the test case management tool Xray to improve test automation coverage for legacy and newer versions of the Corda platform, enabling smooth and frequent patch deliveries every month. The quality engineering process was streamlined for the team's Kanban board by modifying the workflows. Iris also introduced the ability to execute a testing suite that could run on a daily or as-needed basis for AKS, EKS, and Local MAC/ Windows/ Linux cluster environments.

OUTCOMES

The Blockchain-DLT reliability assurance solution enabled the client to attain:

- Improved automation coverage of the DLT platform with 900 test cases with a pass rate of 96% in daily runs

- Compatibility across AWS-EKS, Azure-AKS, Mac, Windows, Linux, and local clusters

- Increased efficiency in deliverables with an annual $35K savings in the test case management area

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchTech stack automation expedites script development by 3x

Manufacturing

Tech stack automation expedites script development by 3x

Manual processes across the multi-technology stack were severely affecting the script development cycles in terms of time, effort and cost. Iris application agnostic Test Automation framework and DevOps integration helped the client reduce the script development time and cost significantly.

Client

A leading building supplies manufacturing company

Goal

To support 30+ applications stack for UI, E2E, APIs, performance, mobile automation along with DevOps pipeline integration

Tools and technologies

.NET Core, PeopleSoft, Salesforce, WMS, JavaScript, Angular, Foxpro, C#, Selenium, SpecFlow, RestSharp, Nunit, Mobile Center/Emulators, Allure, Jira, Azure Pipeline, GitHub

BUSINESS CHALLENGE

The client had technology stacks comprising of diverse technologies that were difficult to manage. Substantial manual effort and time were spent on integrating the checkpoints, elongating the development process. Validating end-to-end business flows across different applications was the prime challenge. Reporting processes were also scattered across the entire application stack, making it vulnerable.

SOLUTION

Iris developed a robust application agnostic Test Automation framework to support the client’s multiple-technology stacks. Following the Behavior-driven Development (BDD) approach to align the acceptance criteria with the stakeholders, we built business and application layers of the common utilities in the core framework. Our experts identified E2E business flows to validate the downstream impact of the change and automated the entire stack through the shift-left approach. Azure DevOps integration enabled a common dashboard for reporting. The client attained complete version control to track production health and enforce strong validations.

OUTCOMES

Iris Automation solution enabled the client to surpass several business goals. The key outcomes of the delivered solution included:

- ~65% Increase in automation coverage

- 100+ Pipelines for in-scope applications across multiple environments

- 3700+ Test Automation scripts execution per sprint cycle achieved across applications

- 3X Faster script development of behavior-driven test cases

- Multi-day manual test effort reduced to a few hours of automated regression

- 70% Reduction in effort

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchIT modernization boosts Insurance customer base

Insurance

IT modernization boosts Insurance customer base

Existing applications and business systems of a Fortune 500 Insurance Carrier were inadequate to meet customer expectations. Iris business systems transformation solution enabled the client to deliver a consistent customer experience, improving acquisition and retention significantly.

Client

A leading American Fortune 500 Insurance Services Provider, offering insurance, investment management and other financial products and services across the Americas and 40 other countries

Business Drivers

To advance business agility and customer experience through modernized business systems

Technologies and Frameworks

C#/.NET, JAVA, DevOps, Python, NodeJS, App Services, Managed Application Support

BUSINESS CHALLENGE

SOLUTION

OUTCOMES

- Infrastructure availability increased to 99%

- Optimized maintainability reduced the KYC process time by 75%

- Customer response time cut down by around 40%

- Promoter score incremented from 5 to 9 out of 10

- Customer retention improved by nearly 80%

- Customer acquisition increased by 65%

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchCloud transformation increases business agility

Standards & Membership

Global Standards organization increases business agility

Existing applications supporting the business were built on monolith architecture with high technical debt. Iris transformed over 15 years old monolith applications into microservices with automated integration and cloud deployment to deliver faster MVPs.

Client

A non-profit global organization responsible for developing and maintaining standards, including barcodes with over 115 local member organizations and over 2 million user companies

Business Drivers

To deliver MVPs in shorter cycles, reduce Mean Time for Ticket Resolution (MTTR), and lower the total cost of ownership

Tools and technologies

C#/.NET Core, Python/DJango, NodeJS/Express, Azure WAF, Azure APIM, App Services, Azure Kubernetes Service, Azure Monitor, Application Insights

BUSINESS CHALLENGE

SOLUTION

Azure cloud offered some of the foundational features like container orchestration, app engine, integration, API gateway, monitoring and others, making cloud-specific modernization a natural choice.

Modernization strategy involved reverse engineering of on-premise applications, domain-specific grouping the product backlogs by, adopting domain-driven design, and using open source cloud-friendly software with CI/CD pipeline. We transformed the applications to a .NET core framework using cloud-native design principles on Azure cloud. The solution was developed using Azure App Services, front door and service bus following the agile development approach with two-week sprints.

OUTCOMES

Iris helped the client realize multiple business benefits, including higher agility, resiliency and cost-efficient IT operations. Key outcomes of this cloud modernization engagement are:

- Reduction in Mean Time for Ticket Resolution (MTTR) by 30%

- Increase in application and infrastructure uptime to 99.9%

- Real-time visibility of application and infra metrics

- Enabled bi-weekly MVP delivery

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchThe power of in-sprint automation

Client

A leading securities trading firm.

Goal

Build a cloud-based automation framework to test client’s trading platform.

Tools and technologies

C#, Ranorex, TestRail, Simulators and Selenium.

BUSINESS CHALLENGE

SOLUTION

OUTCOMES

Related Stories

Credit risk data migration to cloud

Data migration to cloud enhances leading bank’s credit risk forecasting and analyses while expediting turnaround.

Generative AI platform for business use cases

Generative AI platform offers future-ready AI capabilities and roadmaps for the risk and business teams at a leading bank.

Transforming payment processing for banking channels

Streamlined payments architecture delivers flexible workflow orchestration, system scalability, and improved data reporting.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAn agile sprint for financial data

Client

Among the world’s largest manufacturers of sportswear, the client sells its products in more than 120 countries and employs more than 13,000 people.

Goal

To significantly reduce turnaround time and ease associated with report creation.

Tools and technologies

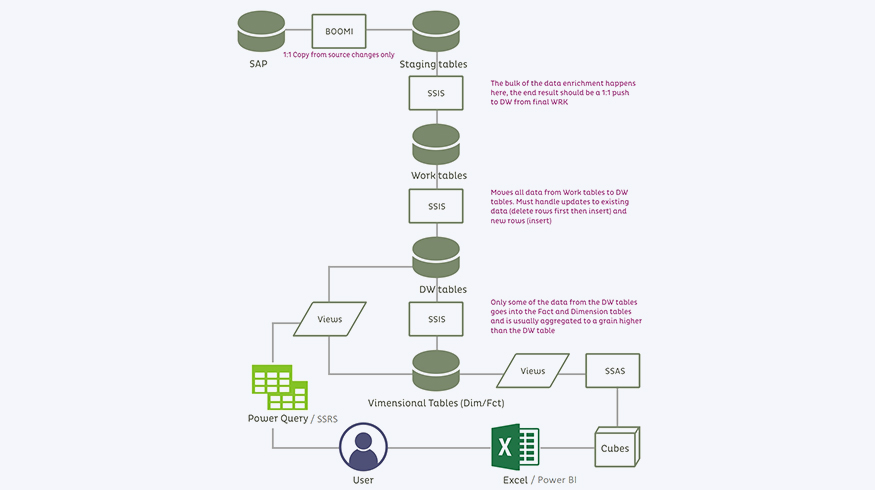

Microsoft SQL Server’s Analysis Services (SSAS), Microsoft SQL Server Integration Services (SSIS), Microsoft SQL Server Reporting Services (SSRS), Boomi AtomSphere, and Power BI.

BUSINESS CHALLENGE

SOLUTION

OUTCOMES

Related Stories

Credit risk data migration to cloud

Data migration to cloud enhances leading bank’s credit risk forecasting and analyses while expediting turnaround.

Generative AI platform for business use cases

Generative AI platform offers future-ready AI capabilities and roadmaps for the risk and business teams at a leading bank.

Transforming payment processing for banking channels

Streamlined payments architecture delivers flexible workflow orchestration, system scalability, and improved data reporting.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchDeliver personalization via report automation

Client

A leading asset management firm based in the U.S.

Goal

Help asset managers deliver personalized solutions to establish differentiation.

Tools and technologies

AquaData Studio, Java, Perl, Python, Spring, Hibernate, VRS, PostgreSQL, Composite and MS SQL.

BUSINESS CHALLENGE

- Its front, mid and back office functions needed a lot of manual effort

- Business rules were inconsistent and data duplication was rampant

- User experience on the platform needed significant improvement

- Clients were unable to get a holistic view of their accounts

- Data validation was consuming a lot of manhours

SOLUTION

- Our team streamlined and integrated the client’s front, middle and back office functions. We helped the client integrate their back-office solutions with their custodians, reducing complexity in information exchange, eliminating reconciliation and increasing operational efficiency by more than 75%.

- We automated the creation of more than 7,000 reports.

- Improved experience for retail and institutional clients by automating the generation of complex compliance and strategic reports.

- Developed a strategic reporting module that gave customers a holistic view of their accounts and holdings.

- Set up a business data validation team offshore.

- Enabled self-service option for bespoke reports.

OUTCOMES

- Automated the exhibits process with 75% increase in throughput

- Our report automation solution reduced manual effort by 70% and improved monthly artefact generation throughput by 40%

- Reduced manual effort for customization in client profile management by 60%

- Achieved $50,000 savings monthly in data validation for client profile management

Related Stories

Transforming payment processing for banking channels

Streamlined payments architecture delivers flexible workflow orchestration, system scalability, and improved data reporting.

Seamless 24/7 Operations with App Management

Holistic administration of diverse tech stack achieves business continuity, 25% more system uptime and 99% SLA compliance.

Modernized Payments Hub Improves UX and Compliance

An elevated core payments engine improves client experience through seamless integration and increased functionality.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchCompany