Anti-Money Laundering & Know-Your-Customer

Conversational assistant boosts AML product assurance

Client

A large global bank

Goal

Improve turnaround time to provide technical support for the application support and global product assurance teams

Tools and Technologies

React, Sentence–Bidirectional Encoder Representations from Transformers (S-BERT), Facebook AI Similarity Search (FAISS), and Llama-2-7B-chat

Business Challenge

The application support and global product assurance teams of a large global bank faced numerous challenges in delivering efficient and timely technical support as they had to manually identify solutions to recurring problems within the Known Error Database (KEDB), comprised of documents in various formats. With the high volume of support requests and limited availability of teams across multiple time zones, a large backlog of unresolved issues developed, leading to higher support costs.

Solution

Our team developed a conversational assistant using Gen AI by:

- Building an interactive customized React-based front-end

- Ringfencing a corpus of problems and solutions documented in the KEDB

- Parsing, formatting and extracting text chunks from source documents and creating vector embeddings using Sentence–Bidirectional Encoder Representations from Transformers (S-BERT)

- Storing these in a Facebook AI Similarity Search (FAISS) vector database

- Leveraging a local Large Language Model (Llama-2-7B-chat) to generate summarized responses

Outcomes

The responses generated using Llama-2-7B LLM were impressive and significantly reduced overall effort. Future enhancements to the assistant would involve:

- Creating support tickets based on information collected from users

- Categorizing tickets based on the nature of the problem

- Automating repetitive tasks such as access requests / data volume enquiries / dashboard updates

- Auto-triaging support requests by asking users a series of questions to determine the severity and urgency of the problem

Our experts can help you find the right solutions to meet your needs.

AI-powered summarization boosts compliance workflow

Client

A leading specialty property and casualty insurer

Goal

Improve underwriters’ ability to review policy submissions by providing easier access to information stored across multiple, voluminous documents.

Tools and Technologies

Azure OpenAI Service, React, Azure Cognitive Services, Llama-2-7B-chat, OpenAI GPT 3.5-Turbo, text-embedding-ada-002 and all-MiniLM-L6-v2

Business Challenge

The underwriters working with a leading specialty property and casualty insurer have to refer to multiple documents and handbooks, each running into several hundreds of pages, to understand the relevant policies and procedures, key to the underwriting process. Significant effort was required to continually refer to these documents for each policy submission.

Solution

A Gen-AI enabled conversational assistant for summarizing information was developed by:

- Building a React-based customized interactive front end

- Ringfencing a knowledge corpus of specific documents (e.g., an insurance handbook, loss adjustment and business indicator manuals, etc.)

- Leveraging OpenAI embeddings and LLMs through Azure OpenAI Service along with Azure Cognitive Services for search and summarization with citations

- Developing a similar interface in the Iris-Azure environment with a local LLM (Llama-2-7B-chat) and embedding model (all-MiniLM-L6-v2) to compare responses

Outcomes

Underwriters significantly streamlined the activities needed to ensure that policy constructs align with applicable policies and procedures and for potential compliance issues in complex cases.

The linguistic search and summarization capabilities of the OpenAI GPT 3.5-Turbo LLM (170 bn parameters) were found to be impressive. Notably, the local LLM (Llama-2-7B-chat), with much fewer parameters (7 bn), also produced acceptable results for this use case.

Our experts can help you find the right solutions to meet your needs.

Life Insurance & Annuity Conference 2024

With the theme, Powering Growth, the 2024 Life Insurance & Annity Conference, jointly hosted by LIMRA, LOMA, ACLI, and SOA, will be held at the Marriott Rivercenter in San Antonio, Texas, from April 15 to 17, 2024.

The Conference will feature peer networking and expert insights, with more than 30 workshops that will provide deep dives into topics of major significance to the insurance industry, including: technological and product innovation; financial crime and compliance; consumer, regulatory and resource demands; and market growth.

While you’re at this year’s Life Insurance & Annuity Conference, look up Venkat Laksh, Iris Software’s global lead in insurance, or contact him anytime afterward, to learn how insurers are applying our InsurTech Solutions - in AI/ML, Application Modernization, Automation, Cloud, Data Science, Enterprise Analytics, and Integrations – to power their growth, by optimizing business competencies, enhancing customer experiences, meeting challenges, and securing digital transformation.

You can also contact Venkat or learn more about Iris’ InsurTech Services and Solutions that help future-proof insurance enterprises here: Insurance Technology Services | Iris Software.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAutomated financial analysis reduces manual effort

Commercial & Corporate Banking

Automated financial analysis reduces manual effort

Client

Commerical lending and credit risk units of large North American bank

Goal

Automated retrieval of information from multiple financial statements enabling data-driven insights and decision-making

Tools and Technologies

OpenAI API (GPT-3.5 Turbo), LlamaIndex, LangChain, PDF Reader

Business Challenge

A leading North American bank had large commercial lending and credit risk units. Analysts in those units typically refer to numerous sections in a financial statement, including balance sheets, cash flows, and income statements, supplemented by footnotes and leadership commentaries, to extract decision-making insights. Switching between multiple pages of different documents took a lot of work, making the analysis extra difficult.

Solution

Many tasks were automated using Gen AI tools. Our steps:

- Ingest multiple URLs of financial statements

- Convert these to text using the PDF Reader library

- Build vector indices using LlamaIndex

- Create text segments and corresponding vector embeddings using OpenAI’s API for storage in a multimodal vector database e.g., Deep Lake

- Compose graphs of keyword indices for vector stores to combine data across documents

- Break down complex queries into multiple searchable parts using LlamaIndex’s DecomposeQueryTransform library

Outcomes

The solution delivered impressive results in financial analysis, notably reducing manual efforts when multiple documents were involved. Since the approach is still largely linguistic in nature, considerable Prompt engineering may be required to generate accurate responses. Response limitations due to the lack of semantic awareness in Large Language Models (LLMs) may stir considerations about the usage of qualifying information in queries.

Our experts can help you find the right solutions to meet your needs.

Next generation chatbot eases data access

Brokerage, Wealth & Asset Management

Next generation chatbot eases data access

Client

Large U.S.-based Brokerage and Wealth Management Firm

Goal

Enable a large number of users to readily access summarized information contained in voluminous documents.

Tools and Technologies

Google Dialogflow ES, Pinecone, Llamaindex, OpenAI API (GPT-3.5 Turbo)

Business Challenge

A large U.S.-based brokerage and wealth management client has a large number of users for its retail trading platform that offers sophisticated trading capabilities. Although extensive information was documented in hundreds of pages of product and process manuals, it was difficult for users to access and understand information related to their specific needs (e.g., How is margin calculated? or What are Rolling Strategies? or Explain Beta Weighting).

Solution

Our Gen AI solution encompassed:

- Building a user-friendly interactive chatbot using Dialogflow in Google Cloud

- Ringfencing a knowledge corpus comprising specific documents to be searched against and summarized (e.g., 200-page product manual, website FAQ content)

- Using a vector database to store vectors from the corpus and extract relevant context for user queries

- Interfacing the vector database with OpenAI API to analyze vector-matched contexts and generate summarized responses

Outcomes

The OpenAI GPT-3.5 turbo LLM (170 bn parameters) delivered impressive linguistic search and summarization capabilities in dealing with information requests. Prompt engineering and training are crucial to secure those outcomes.

In the case of a rich domain such as a trading platform, users may expect additional capabilities, such as:

- API integration, to support requests requiring retrieval of account/user specific information, and

- Augmentation of linguistic approaches with semantics to deliver enhanced capabilities.

Our experts can help you find the right solutions to meet your needs.

Home » Industries » Page 7

The State of Central Bank Digital Currency

Innovations in digital currencies could redefine the concept of money and transform payments and banking systems.

Do you trust your data?

Data driven organizations are ensuring that their Data assets are cataloged and a lineage is established to fully derive value out of their data assets.

Central banking institutions have emerged as key players in the world of banking and money. They play a pivotal role in shaping economic and monetary policies, maintaining financial system stability, and overseeing currency issuance. A manifestation of the evolving interplay between central banks, money, and the forces that shape financial systems is the advent of Central Bank Digital Currency (CBDC). Many drivers have led central banks to explore CBDC: declining cash payments, the rise of digital payments and alternative currencies, and disruptive forces in the form of fin-tech innovations that continually reshape the payment landscape.

Central banks are receptive towards recent technological advances and well-suited to the digital currency experiment, leveraging their inherent role of upholding the well-being of the monetary framework to innovate and facilitate a trustworthy and efficient monetary system.

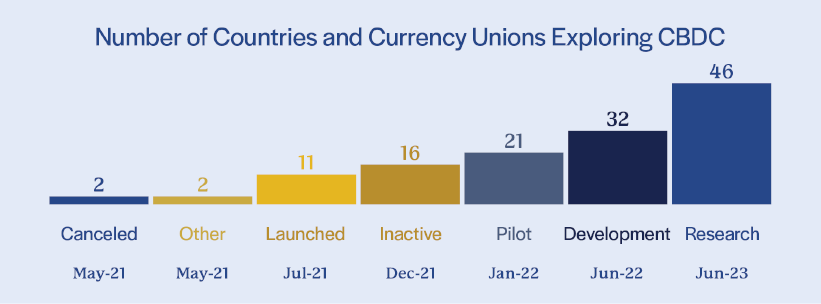

In 2023, 130 countries, representing 98% of global GDP, are known to be exploring a CBDC solution. Sixty-four of them are in an advanced phase of exploration (development, pilot, or launch), focused on lower costs for consumers and merchants, offline payments, robust security, and a higher level of privacy and transparency. Over 70% of the countries are evaluating digital ledger technology (DLT)-based solutions.

While still at a very nascent stage in terms of overall adoption for CBDC, the future of currency promises to be increasingly digital, supported by various innovations and maturation. CBDC has the potential to bring about a paradigm shift, particularly in the financial industry, redefining the way in which money, as we know it, exchanges hands.

Read our perspective paper to learn more about CBDCs – the rationale for their existence, the factors driving their implementation, potential ramifications for the financial landscape, and challenges associated with their adoption.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchMeet us at InsureTech Connect Vegas 2023

With the theme, “The Future of Insurance is Here,” InsureTech Connect’s annual conference, ITC Vegas, noted as the world’s largest gathering of insurance innovation, will be at Mandalay Bay in Las Vegas, Nevada, from October 31 to November 2, 2023.

The Conference features 14 educational tracks that will showcase insurance industry leaders, top use cases, and actionable insights relevant to the 9,000+ insurers, innovators and entrepreneurs from around the world who are expected to attend. Technology applications and advancements will be a major focus in each session.

Meet up with Venkat Laksh, Iris Software’s global lead in insurance, at ITC Vegas 2023 or afterward to learn how insurers are applying our InsurTech Solutions in automation, AI, data science, enterprise analytics and cloud, to amplify their business competencies and secure their digital futures.

You can also contact Venkat or learn more about the InsurTech services and solutions that help future-proof insurance enterprises here: Insurance Technology Services.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchConnect at the NMSDC 2023 Conference & Exchange

As a long-time, certified Minority Business Enterprise (MBE) and strategic partner of the National Minority Supplier Development Council (NMSDC), we are pleased to again participate in its annual Conference & Exchange. This year, it’s at the Baltimore, Maryland Convention Center from October 23-25, 2023.

Venkat Laksh, Global Lead - Insurance, will represent Iris. Connect with him there, or at any time, to learn how our advanced technology solutions and services benefit our clients’ digital transformation journeys as well as support their CSR and DEI commitments.

Iris’ successful growth journey over the past 32 years and our experience delivering Automation, Cloud, Data & Analytics, and Integrations, leveraging emerging tools like artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), to Fortune 500 and other companies in varied industries, including Financial Services and Insurance, sync perfectly with NMSDC’s mission and the Conference agenda. You can find those here: About (nmsdcconference.org).

The NMSDC Conference & Exchange provides several days of networking and educational opportunities for C-suite executives, supplier diversity and procurement professionals, and MBEs. Take the opportunity to connect with Venkat Laksh at the 2023 Conference or afterward to discuss how Iris’ capabilities can help your enterprise realize the benefits of future-ready technology.

You can also visit Industry-specific tech services to learn more and contact us.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchJoin us at the Women in Payments Symposium 2023

Each year, the Global Association of Women Leaders in Payments hosts annual forums in several regions around the world for women payments professionals to connect, share ideas, learn the latest trends and challenges in fintech and the payments market, and to advance change. These annual events usually feature a theme as well as presentations and workshops with many of the industry’s top female leaders.

Pallavi Bhargava, Client Partner, is attending the Women in Payments Symposium 2023 in Toronto, Canada at the Westin Harbour Castle Hotel on October 11 and 12. She will be available there and afterward to discuss how Iris Software’s capabilities help organizations in the payments industry realize the benefits of future-ready technology.

The theme of this Symposium is Future Focus. One of the session introductions nicely expresses why: “Banks and businesses…have embarked on a modernization journey, trying to re-imagine their systems and get ready for the world of tomorrow. While each institution has paved their own path, all are seeking common goals; integration into new technologies, cost reduction, improved risk and security management, and operational efficiency and many are yet to start.”

With the continual growth and evolvement of e-commerce, digital currencies, real-time payments, security, liquidity, and fintech, many banks and financial services and payment providers are applying emerging technologies in automation, cloud adoption, and advanced data & analytics to future-proof their businesses.

As an experienced provider of data engineering, enterprise analytics, automation, cloud, DevOps and integration solutions to banks and financial services companies that provide payment card processing and transactions, Iris is knowledgeable about the rapid advances in these areas and leveraging accelerators like AI/ML and NLP.

Further, Iris is PCIDSS 4.0 certified to ensure robust cyber security and compliance for our clients. The Payment Card Industry Data Security Standard applies to all entities involved in payment card processing, as well as all other entities that store, process, or transmit cardholder data and/or sensitive authentication data.

Visit Core Banking Solution: Banking Software Consulting Services to explore our innovative approach and strategies and to get in touch.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchRelease automation reduces testing time by 80%

Client

A leading multi-level marketing company

Goal

Shorten the release cycle and improve product quality

Technology Tools

Amazon CloudWatch, Elasticsearch, Bitbucket, Jenkins, Amazon ECR, Docker, and Kubernetes

Business Challenge

The client's Commercial-off-the-shelf (COTS) applications were built using substandard code branching methods, causing product quality issues. The absence of a release process and a manual integration and deployment process were elongating release cycles. Manual configuration and setup of these applications were also leading to extended downtime. Missing functional, smoke, and regression test cases were adding to the unstable development environment. The database migration process was manual, resulting in delays, data quality issues, and higher costs.

Solution

- Code branching and integration strategy for defects / hotfixes in major and minor releases

- Single-click application deployment, including environment creation, approval and deployment activities

- Global DevOps platform implementation with a launch pad for applications to onboard other countries

- Automated configuration and deployment of COTS applications and databases

- Automation suite with 90% coverage of smoke and regression test cases

- Static and dynamic analysis implementations to ensure code quality and address configuration issues

Outcomes

Automation of release cycles delivered the following benefits to the client:

- Release cycle shortened from once a month to once per week

- MTTR reduced by 6 hrs

- Downtime decreased to <4 hours from 8 hours

- Product quality and defect leakage improved by 75%

- Testing time reduced by 80%

- Reach expanded to global geographies

- Availability, scalability, and fault tolerance enhanced for microservices-based applications

Our experts can help you find the right solutions to meet your needs.

Industries

Company