Client

A top 5 global bank

Goal

Create a unified platform for anti-money laundering functions, analytics, and compliance implementations

Tools and technologies

Angular 5, Java, Open Shift, and DevOps

BUSINESS CHALLENGE

The client expanded its fraud and anti-money laundering (AML) monitoring functions, involving multiple lines of business and 15,000 employees. The scaled system led to the lack of standardization of frameworks and resultant adoption of disjointed, manual-intensive, and high-cost AML technology. The ongoing disconnect hindered the efforts of automating, consolidating; and implementing AML functions, enterprise analytics, and regulatory compliance efficiently throughout the organization.

SOLUTION

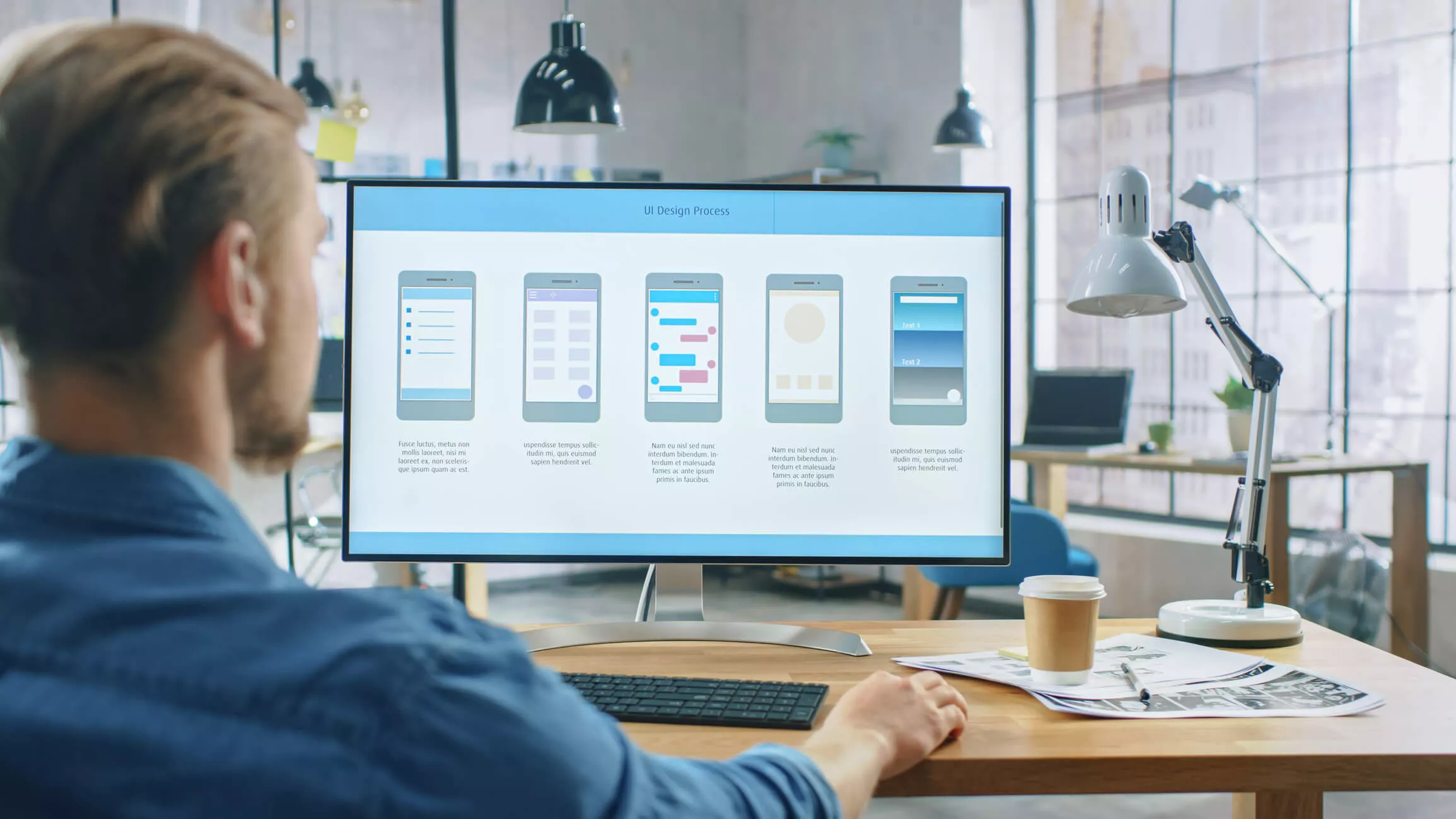

Iris optimized existing operations and technology investments by developing and implementing a unified point of access for the discrete AML functions, featuring micro-front-end architecture. Engineered to be horizontally scalable through containerization with common authentication and authorization gateways, the single user interface (UI) allows onboarding and control of multiple extended AML functions, including visualization of metrics.

OUTCOMES

- Hassle-free transition from multiple to a single UI

- Unified, streamlined user experiences with more effective sessions

- Creation of standardized deployment procedures for AML rules and applications

- Saving of nearly $1M on infrastructure costs

- Reduced infrastructure maintenance time

- Frictionless migration of applications to the cloud

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchA legacy portfolio gets a makeover

Conquering the cloud

Iris developed a multi-device mobile ticketing and permitting application that seamlessly integrated with local government systems using cloud technology for more efficient law enforcement.

Conquering the cloud

Iris developed a multi-device mobile ticketing and permitting application that seamlessly integrated with local government systems using cloud technology for more efficient law enforcement.

Conquering the cloud

Iris developed a multi-device mobile ticketing and permitting application that seamlessly integrated with local government systems using cloud technology for more efficient law enforcement.

Title

Title

Title

Client

The client is one of the Big Four advisory firms.

Goal

Modernize the legacy application to meet growing business needs.

Tools and technologies

MS SharePoint, MS .Net and MS SQL Server.

BUSINESS CHALLENGE

- Lack of integration: Most of the integration with upstream and downstream systems was manual, resulting in common data getting obsolete quickly.

- The client was finding it difficult and expensive to hire and retain resources to maintain the legacy apps.

- The legacy system was prone to security breaches and couldn’t be deployed on the enterprise-level stack.

- The existing system supported only single-user applications, and it wasn’t possible to roll them out to multiple users.

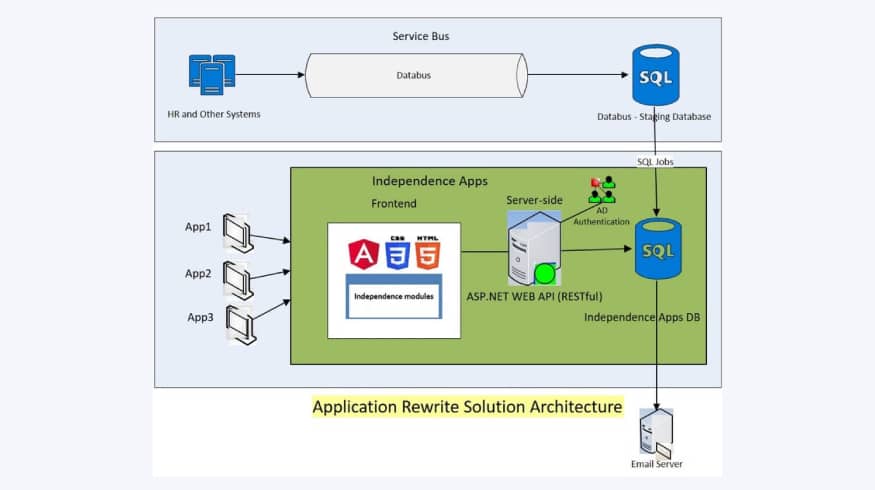

SOLUTION

- Upgraded the technology stack for the application(s) to lower maintenance costs, improve efficiency and meet growing business needs.

- Used an in-house technology modernization framework to reduce development and maintenance costs.

- Consolidated applications that were doing similar tasks and had similar features and modernized them.

- Retired applications, whose features were available through other applications.

OUTCOMES

- With the legacy modernization and application consolidation process, we reduced the client’s application portfolio from 45 applications to less than 10.

- Reduced the resources required for maintenance from six to two.

- The framework-based approach accelerated time-to-market, a critical differentiator for the client.

Related Stories

Anti-money laundering software saves $1M

Global bank overcomes AML monitoring challenges and saves $1M in infrastructure costs with a unified front-end.

How to transform your risk reporting mechanisms

A future-ready risk reporting platform helped a leading brokerage firm improve its user interfaces and lower costs.

Data consolidation speeds up drug search

A pharmaceutical company improved turnaround time for APRs and automated manual work.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAn agile sprint for financial data

Client

Among the world’s largest manufacturers of sportswear, the client sells its products in more than 120 countries and employs more than 13,000 people.

Goal

To significantly reduce turnaround time and ease associated with report creation.

Tools and technologies

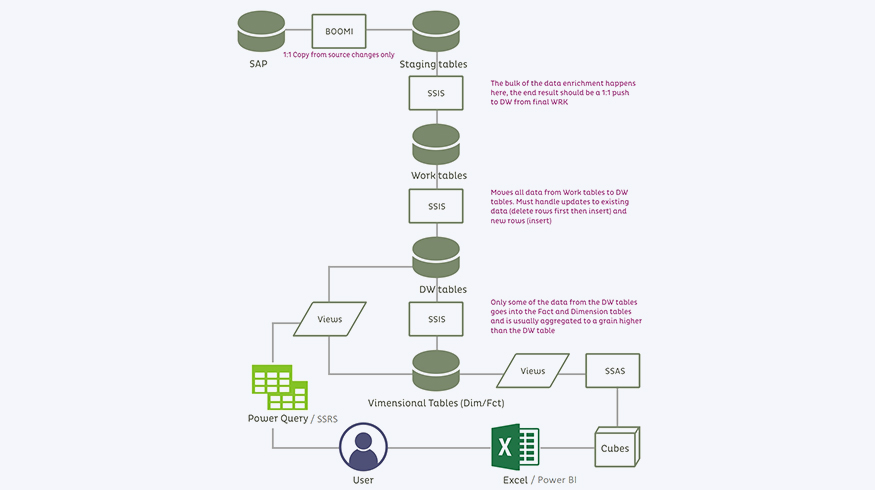

Microsoft SQL Server’s Analysis Services (SSAS), Microsoft SQL Server Integration Services (SSIS), Microsoft SQL Server Reporting Services (SSRS), Boomi AtomSphere, and Power BI.

BUSINESS CHALLENGE

SOLUTION

OUTCOMES

Related Stories

Data warehouse enhances client communications

Bank’s multi-channel client communications and portfolio management capabilities improved with investment data warehouse

Cloud Data Lakehouse for Single Source of Truth

Transformation of data and BI applications to MS Azure cloud deliveres “Order to Cash” sales analytics on cloud for a life sciences company.

Platform re-engineering for operational efficiency

A leading brokerage bank improved operational efficiencies with data extraction platform modernization.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchA playbook for banks on managing M&A integration

Client

Banks that have merged or acquired new businesses.

Goal

Manage migration and integration complexity post M&A.

Tools and technologies

The Iris business acquisition playbook for banks.

BUSINESS CHALLENGE

Solution

- Consolidate multiple acquisition playbooks to create a single standardized framework for their lending business

- Define insourcing steps for business and technology teams and create a migration strategy with quantifiable recommendations and a reusable checklist for insourcing activities.

- Assess capability and readiness and help them choose from insourcing options:

- Achieve full migration of data and systems

- Achieve partial migration of systems and data migration and integration

- Manage data integration and connectivity for lending business.

Outcomes

Related Stories

Gen AI summarization solution aids lending app users

Custom summarization solution using Gen AI eases lenders’ information access, complex app usage, and new user onboarding.

Conversational assistant boosts AML product assurance

Gen AI-powered responses enhance the operational efficiency of the AML global product assurance team and reduce cost.

Automated financial analysis reduces manual effort

Analysts in commercial lending and credit risk units are able to source intelligent information across multiple documents.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchAn API ecosystem expedites customer onboarding

Client

The client is a leading logistics and transportation services provider, ranked among the top 10 in the world.

Goal

Rapid onboarding of partners and customers; improve customer experience.

Tools and technologies

Azure, Dell Boomi APIM and oAuth 2.

BUSINESS CHALLENGE

The growing volume of business required the client to respond faster to market demands. On their current systems, it was a challenge for the support staff to onboard new clients and service their requests.

The client needed a solution that would help it respond quickly to diverse business needs, including:

- Last mile shipment tracking and alerts across carrier networks

- Quotes for multiple shipment options

- Special fulfilment orders

- Order personalization for seasonal surges

SOLUTION

We proposed and developed a comprehensive API layer that allowed customers and partners to access client systems using APIs.

Customers and partners could easily track shipments and get quotes on their own. This reduced the need for support personnel to service routine requests. The team configured these APIs on Boomi’s API Management to enable seamless real-time integration.

OUTCOMES

- Improved onboarding speed: 20+ partners per month

- Enabled client to handle large volumes of requests, with a service capacity of 35,000 API requests a day

- Improved customer experience through real-time rates and quotes

Related Stories

Gen AI interface enhances API productivity and UX

Integrating Generative AI technology into a leading logistics provider’s developer portal reduces API onboarding to 1-2 days.

API migration benefits leading logistics company

Phased migration of Boomi APIs to Apigee helps a leading transportation and logistics company improve performance and scale

Anti-money laundering software saves $1M

Global bank overcomes AML monitoring challenges and saves $1M in infrastructure costs with a unified front-end.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchCompany