Client

A leading home insurance enterprise specializing in policy administration solutions

Goal

Develop policy administration applications for partner insurance carriers with seamless third-party and home-grown app integration

Tools and Technologies

Low-Code/No-Code Platform, AWS, Agile Development, Containerization

Business Challenge

The client needed a scalable policy administration solution to support insurance carriers, integrate third-party applications, and enhance policy issuance and settlement.

The goal was to accelerate the go-to-market process for partners and agents while delivering premier services for competitive pricing and superior policy coverage.

Solution

- Designed and developed a policy administration platform using a Low-Code/No-Code application development platform on AWS

- Built three Agile Pod-based teams, each containing five members for rapid iteration and development

- Leveraged containerized development, ensuring each service had its own lifecycle for enhanced flexibility and scalability

- Established weekly release plans with feature flags to enable controlled functionality deployment in production once the business was ready to adopt

Outcomes

- 200% growth in policy issuance

- Faster onboarding for agencies and agents

- Improved efficiency and scalability in policy administration

- Accelerated go-to-market for insurance partners and agents

Our experts can help you find the right solutions to meet your needs.

InsurTech NY 2025 Spring Conference

The annual InsurTech NY Spring Conference is April 2-3, 2025, at Chelsea Piers in New York City. The theme of this year’s forum is InsurTech is the New R&D. The event brings together 900+ leaders and innovators in the industry, including carriers and brokers of life, health and disability, property and casualty (P&C), and specialty insurance; investors; and insurtech service providers like Iris Software. Each year, speakers and attendees focus on the technology and business management solutions that will enhance the operations, customer experience, and revenue streams of insurers.

Meet the leaders of our global InsurTech team - Ravi Chodagam, Vice President, Venkat Laksh and Abhineet Jha, Senior Client Partners - at InsurTech NY’s 2025 Spring Conference. As an integral and long-time technology partner to many top life, P&C, and specialty insurers, Iris has vast experience implementing agile and advanced technology and data solutions that ensure clients stay competitive and ahead of rapidly evolving trends in the dynamic insurance industry.

Discuss your tech priorities with Ravi, Venkat and Abhineet at the Spring Conference, or anytime, and learn how leading insurers apply our solutions in AI and Generative AI, Application Modernization, Automation, Cloud, and Data Science & Analytics to ensure their enterprises are future-ready, scalable, secure, cost-efficient, and compliant. You can also contact the team and learn more about our InsurTech Services here: Insurance Technology Services | Iris Software.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touch

How Gen AI Can Transform Software Engineering

Unlocking efficiency across the software development lifecycle, enabling faster delivery and higher quality outputs.

Generative AI has enormous potential for business use cases, and its application to software engineering is equally promising.

In our experience, development activities, including automated test and deployment scripts, account for only 30-50% of the time and effort spent across the software engineering lifecycle. Within that, only a fraction of the time and effort is spent in actual coding. Hence, to realize the true promise of Generative AI in software engineering, we need to look across the entire lifecycle.

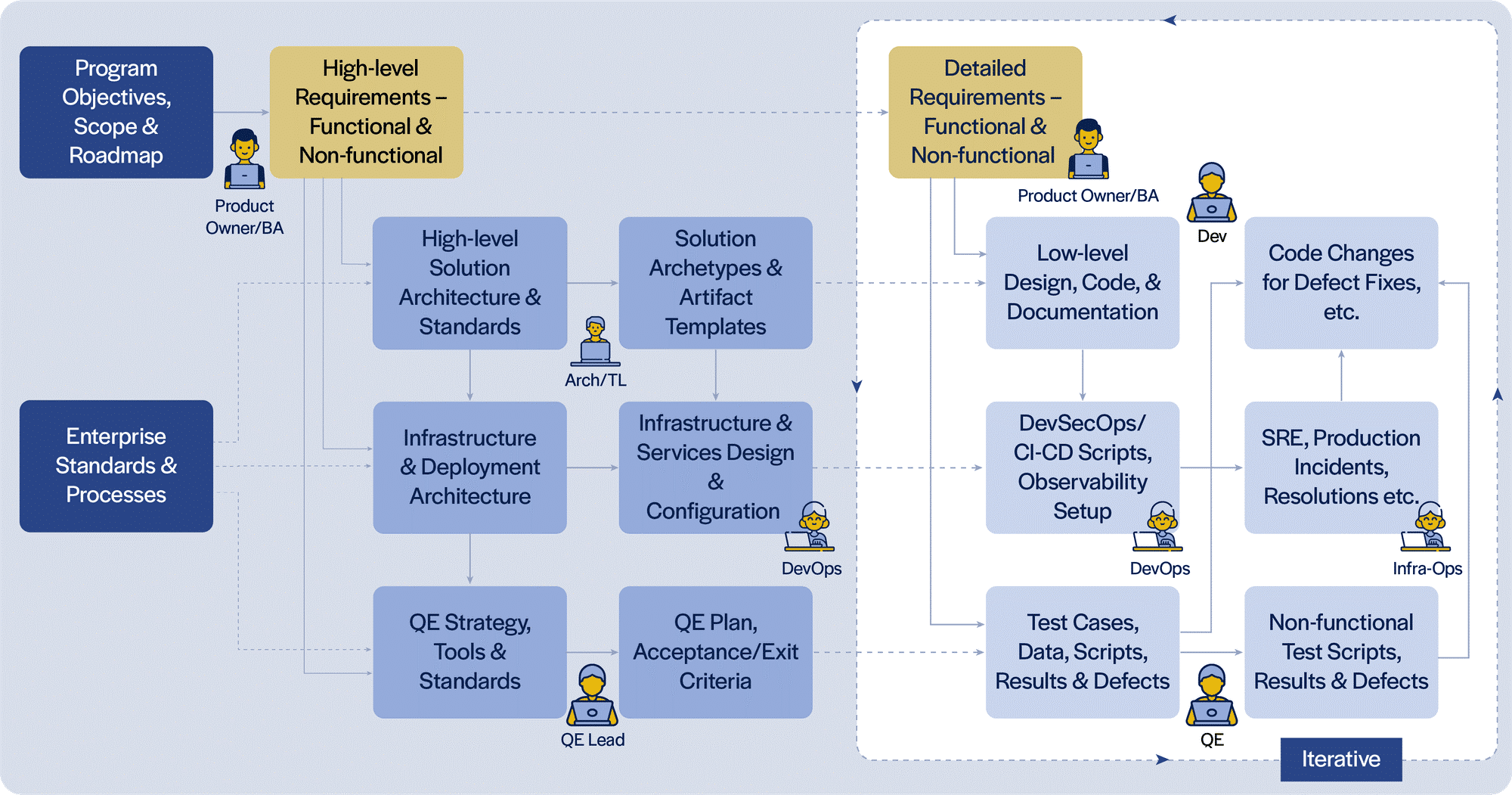

A typical software engineering lifecycle involves a number of different personas (Product Owner, Business Analyst, Architect, Quality Assurance/ Tech Leads, Developer, Quality/ DevSecOps/ Platform Engineers), each using their own tools and producing a distinct set of artifacts. Integrating these different tools through a combination of Gen AI software engineering extensions and services will help streamline the flow of artifacts through the lifecycle, formalize the hand-off reviews, enable automated derivation of initial versions of related artifacts, etc.

As an art-of-the-possible exercise, we developed extensions (for VS Code IDE and Chrome Browser at this time) incorporating the above considerations. Our early experimentation suggests that Generative AI has the potential to enable more complete and consistent artifacts. This results in higher quality, productivity and agility, reducing churn and cycle time, across parts of the software engineering lifecycle that AI coding assistants do not currently address.

Complementary approaches to automate repetitive activities through smart templating, leveraging Generative AI and traditional artifact generation and completion techniques can help save time, let the team focus on higher-value activities and improve overall satisfaction. However, there are key considerations in order to do this at scale across many teams and team members. To enable teams to become high-performant, the Gen AI software engineering extensions and services need to provide capabilities around standardization and templatization of standard solution patterns (archetypes) and formalize the definition and automation of steps of doneness for each artifact type.

Read our perspective paper for more insights on How Gen AI Can Transform Software Engineering through streamlined processes, automated tasks, and augmented collaboration, bringing faster, higher-quality software delivery.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchData migration to cloud expedites credit risk functions

Client

A leading North American bank

Goal

Migrate credit risk data and SAS-based analytics models from on-premises data warehouse to AWS to enhance functionality

Tools and Technologies

AWS Glue, Redshift, DataSync, Athena, CloudWatch, SageMaker; Apache Airflow; Delta Lake; Power BI

Business Challenge

The credit risk unit of a major bank aimed to migrate SAS-based analytics models containing data for financial forecasting and sensitivity analysis to Amazon SageMaker.

This was to leverage benefits such as enhanced scalability, improved maintenance for MLOps engineers, and better developer experience. It also sought to migrate credit risk data from a Netezza-based on-premises data warehouse to AWS, utilizing a data lake on AWS S3 and a data warehouse on Redshift to support model migration.

Solution

- Decoupled data workload processing from relational systems using the phased approach with a focus on historical migration, transformational complexities, data volumes, and ingestion frequencies of the incremental loads

- Developed a flexible ETL framework using DataSync for extracting data to AWS as flat files from Netezza

- Transformed data in S3 layers using Glue ETL and moved it to the Redshift data warehouse

- Enabled Glue integration with Delta Lake for incremental data workloads

- Built ETL workflows using Step Functions during orchestration and concurrent runs of the workflow; orchestrated the concurrent runs of workflows using Apache Airflow

- Architected data shift from Netezza to AWS, leveraging a flexible ETL framework

Outcomes

- Enhanced financial forecasting and sensitivity analysis operations with analytical models and data migrated to the AWS public cloud

- Expedited time-to-market catering to client’s downstream consumption needs through Power BI and Amazon SageMaker

Our experts can help you find the right solutions to meet your needs.

Generative AI platform for business use cases

Commercial & Corporate Banking

Gen AI platform offers future-ready capabilities

Client

A leading North American bank

Goal

Provide a wide range of AI capabilities for various risk and business teams and avoid building fragmented, outdated systems

Tools and Technologies

Amazon Bedrock and Titan V2, pgvector, Faiss, OpenSearch, Llama 7B, Claude Sonnet 3.5 and 3.7

Business Challenge

The Enterprise Risk function at a leading North American bank initiated a Generative AI (Gen AI) solution to offer a wide range of AI capabilities, including document intelligence, summarization, generation, translation, and more.

As the project evolved through proofs of concept and pilots, a key challenge emerged: the risk of creating a fragmented ecosystem with an overwhelming array of unmanageable bespoke solutions, model integrations, and reliance on potentially outdated models and libraries.

Solution

Based on prior engagements across clients, our team delivered thought leadership around how to develop and deliver capabilities using a platform approach. We also set up a Minimum Viable Product Team to iterate on new problem areas and solution approaches. Platform development includes generalized capabilities for:

- Setting up document ingestion pipelines, with choice of parsing approaches, embedding models and vector index stores

- A factory model along with configurations for integrating new parsers, embedding models, LLM interfaces etc., to quickly bring new capabilities to the platform

- User management, SSO integration, entitlements management

- API integration to bring in information/ data from internal and external sources

- Platform support of pgvector, Faiss, OpenSearch, Amazon Titan V2, Llama 7B, Claude Sonnet 3.5, and 3.7, etc.

- Intuitive chat interface for AI Masters - designated business users trained in Prompt Engineering and other techniques to assemble new AI/Gen AI capabilities for users through configuration - and end users

Outcomes

- A future-ready Gen AI platform that can easily incorporate new capabilities and updates

- Multiple specific capabilities, called skills, for use by various risk teams and business users

- A forward-looking roadmap, including ability to compose more complex capabilities using atomic capabilities

Our experts can help you find the right solutions to meet your needs.

Join us at Reuters Pharma USA 2025

Reuters Pharma USA 2025 Conference, noted as North America’s largest cross-functional pharmaceutical gathering, is scheduled between March 18-19, 2025, at the Pennsylvania Convention Center in Philadelphia. With the pharmaceutical industry continually pressured by shifts in market trends and participants, product development, consumer sentiment, and government regulations, attendees and speakers at this Conference will be seeking and sharing insights and strategies to best navigate change, remain competitive, and future-proof operational units as well as global enterprises.

Swarnendu Banerjee, client partner and seasoned IT professional for the pharmaceutical and life sciences sectors, will be attending the Reuters Pharma USA 2025 Conference. He will share Iris’ extensive experience in these domains. How our advanced capabilities in AI/Generative AI, Application Development, Intelligent Automation, Cloud, Data & Analytics, Integrations, and Quality Engineering have delivered successful outcomes in mission-critical engagements, ensuring quality and compliance, reducing costs, enhancing UX, modernizing, migrating, scaling, accelerating, and streamlining.

Connect with Swarnendu at the Reuters Pharma forum or anytime, or visit our Services and Life Sciences capabilities pages to explore our innovative approach and strategies for end-to-end digital transformation.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchTransforming payment processing for banking channels

Client

A leading Australian bank

Goal

Streamline the payment transaction lifecycle to handle increasing volume and complexity

Tools and Technologies

Jenkins, Kubernetes, Spring, Oracle, PostgresSQL, AWS, Docker, Kafka, Java

Business Challenge

Multiple banking channels - mobile, internet and branch - initiate various payment requests (20+ types such as ACH, mandate and book transfer) that need to be processed. Depending on the payment type, the channel was required to invoke one or more services in a specific order as per the associated business rules.

Changes to these payment workflows stemming from introduction of new payment types or revisions of business rules introduced complex and repeated changes to the bank’s systems, hindering scalability.

Solution

- To support lifecycle management of various payment transactions, including defining different payment workflows, we designed an event-driven architecture comprised of 40+ microservices (e.g., limit, eligibility, and fraud checks, etc.) supported by a Kafka message queuing system

- The architecture involved building an orchestration engine (landing service), acting as a front controller for all payment workflow requests from the various banking channels, such as mobile, internet and branch

- The landing service in turn invokes the corresponding service (limit, eligibility, etc.) based on the payment type and business rules associated with it

- Data flow between these microservices (resulting from further invocations) and other downstream systems is facilitated asynchronously with the help of a distributed messaging system (Kafka)

- Using Jenkins, we built a CI/CD pipeline to streamline the workflow by automatically building, testing and deploying code changes as they are committed

Outcomes

- Significantly eased the management of payment workflows, including those related to the addition of new payment types (resulting from an acquisition)

- Enabled systems to scale without introducing complex changes at the channels

- Improved reporting, resulting from faster access to data through dedicated microservices

Our experts can help you find the right solutions to meet your needs.

Seamless 24/7 Operations with App Management

Client

A leading manufacturer of roofing materials

Goal

Achieve seamless, 24/7 operations with >95% SLA compliance while efficiently managing diverse technology platforms.

Tools and Technologies

.NET Azure applications and services, Sitecore, MuleSoft, Google Cloud Platform (GCP), PeopleSoft, Salesforce

Business Challenge

Ensuring uninterrupted 24/7 business operations involves supporting and maintaining critical applications across diverse technology stacks. This includes achieving near-perfect Service Level Agreement (SLA) compliance by consistently delivering response and service levels exceeding 95%.

Managing a complex technology ecosystem spanning platforms like .NET, Azure, Salesforce, Sitecore, MuleSoft, GCP, and PeopleSoft, requires expertise and coordination. Additionally, the roofing industry's seasonal nature and frequent deployments lead to unforeseen spikes in incidents and requests, demanding dynamic resource allocation and effective load-management strategies to efficiently meet unpredictable demand.

Solution

- Cross-training of an agile team on all platforms, enabling them to handle spikes without SLA impact, shifting focus dynamically

- Proactive use of monitoring tools and automation, which reduced incidents and resolution time by addressing issues early

- A Gen AI-powered knowledge base documented resolutions, enabling faster, accurate incident handling

- Ensured seamless communication across platform systems, like Salesforce and PeopleSoft, for quick integration fixes

- Regular customer feedback loops and monthly reports aligned system performance with business needs, highlighting insights and improvements

Outcomes

- Near-perfect SLA adherence at 99.9%, ensuring minimal business disruption on an ongoing basis

- Managed 1,100+ incidents per month with a decrease in resolution times stemming from proactive monitoring and streamlined processes

- 25% uptime improvement from proactive maintenance, ensuring high application availability and minimal downtown

- 24/7 load handling that effectively managed spikes during demand surges, maintaining SLAs without extra resources

- Continuous optimization from regular RCAs (Root Cause Analyses) and process enhancements, which reduced incidents and improved system efficiency

Our experts can help you find the right solutions to meet your needs.

Modernized Payments Hub Improves UX and Compliance

Client

U.S. operations of a leading Japanese bank

Goal

Modernize payments architecture to streamline processing and improve client experience

Tools and Technologies

Jenkins, Kafka, Spring, Oracle, JBoss, React, Elastic Search, Java, Node.js

Business Challenge

The evolving payments landscape, with the introduction of ISO 20022 and the dynamic nature of the regulatory environment, necessitated advancement in the bank’s payment processing capabilities.

The lack of a modern architecture hindered client experience, with multiple channels initiating various payment types that required complex processing.

Solution

Our team built a centralized payments hub to orchestrate data flows between payment initiation systems and product processors. The steps:

- Designed a flexible and scalable microservices-based architecture to facilitate translation, enrichment and processing of payment transactions

- Built a messaging layer to streamline data flows between systems, through support for various modes of interaction, e.g., MQ, API and file (canonical / industry standards such as NACHA, SWIFT, JSON, etc.)

- Introduced an API gateway to handle multiple payment types to enable channel agnostic payment capabilities

- Deployed a modular approach to support existing and new systems with isolation of core and product processors and avoid redundancies in capability builds

- Developed a React-based UI as the touchpoint for integrations between the payments hub and other systems

Outcomes

- A core payments engine capable of seamlessly integrating with multiple, complex systems

- Superior client experience, resulting from a holistic view spanning initiation, payment rails, and clearing

- A modernized payments platform that is ISO 20022-compliant and future-ready for processing and reporting needs

- Faster implementation of functionalities for payment processors

Our experts can help you find the right solutions to meet your needs.

New IT ecosystem earns 100% satisfaction rating

Client

A leading global standards organization

Goal

Improve coordination across teams, reduce delivery delays, and streamline support processes for global users

Tools and Technologies

.NET Core, Vue.JS, Python, Docker, Kubernetes, Azure, Angular, Cosmos DB, MS SQL Server, PowerBI, Redis, Azure Functions, Azure Data Factory, Azure App Service, Spring Boot, Java

Business Challenge

The IT ecosystem was spread across multiple vendors and in-house teams, creating significant coordination overheads and challenges. These issues led to member organizations expressing dissatisfaction due to delivery delays and high turnaround times on incidents and problems.

The teams also had to support users across various geographies and time zones, further complicating operations. A lack of standardized customer service processes and knowledge base documentation also hindered issue resolution. Additionally, the teams struggled with awareness of client-specific standards and applications, while needing to handle ad hoc requests and support teams with customer service-specific projects.

Solution

- Three-week discovery phase and six-month transition plan covering 10+ applications, 24/7 Level 2 support, and infra support

- Established service and operations management processes, including governance, tools, and KPIs for agile and ITIL processes

- Set up and maintained Freshdesk ticketing system to manage user requests

- Created detailed SOPs and canned messages in Freshdesk for BAU tracking

- SLA collaboration - worked with L3 team to define resolution SLAs for critical tickets

- Created weekly and monthly reports to track requests, issues, and risks

- Set up a standard process with client to handle access-related requests

Outcomes

- Zero downtime deployments

- Faster on-boarding of member organizations

- Continuous reductions in infra costs on quarter-to-quarter basis

- 100% response and resolution SLA that led to 100% customer satisfaction

- Timely access to all applications for business users

- A one-stop shop via Freshdesk for all ticket information and data for all stakeholders

- Expertise on global standards enables ideas and suggestions to optimize the process for continuous improvement

Our experts can help you find the right solutions to meet your needs.

Industries

Company