The State of Central Bank Digital Currency

Innovations in digital currencies could redefine the concept of money and transform payments and banking systems.

Do you trust your data?

Data driven organizations are ensuring that their Data assets are cataloged and a lineage is established to fully derive value out of their data assets.

Central banking institutions have emerged as key players in the world of banking and money. They play a pivotal role in shaping economic and monetary policies, maintaining financial system stability, and overseeing currency issuance. A manifestation of the evolving interplay between central banks, money, and the forces that shape financial systems is the advent of Central Bank Digital Currency (CBDC). Many drivers have led central banks to explore CBDC: declining cash payments, the rise of digital payments and alternative currencies, and disruptive forces in the form of fin-tech innovations that continually reshape the payment landscape.

Central banks are receptive towards recent technological advances and well-suited to the digital currency experiment, leveraging their inherent role of upholding the well-being of the monetary framework to innovate and facilitate a trustworthy and efficient monetary system.

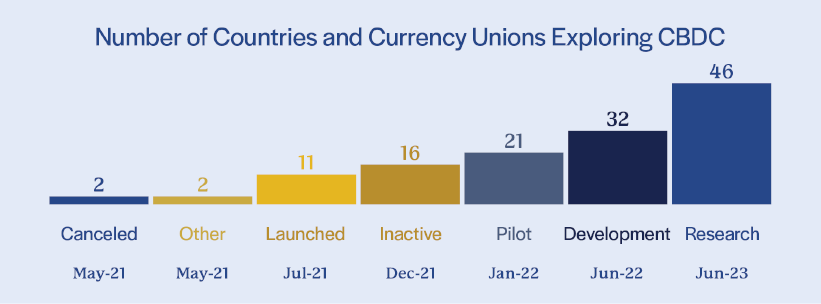

In 2023, 130 countries, representing 98% of global GDP, are known to be exploring a CBDC solution. Sixty-four of them are in an advanced phase of exploration (development, pilot, or launch), focused on lower costs for consumers and merchants, offline payments, robust security, and a higher level of privacy and transparency. Over 70% of the countries are evaluating digital ledger technology (DLT)-based solutions.

While still at a very nascent stage in terms of overall adoption for CBDC, the future of currency promises to be increasingly digital, supported by various innovations and maturation. CBDC has the potential to bring about a paradigm shift, particularly in the financial industry, redefining the way in which money, as we know it, exchanges hands.

Read our perspective paper to learn more about CBDCs – the rationale for their existence, the factors driving their implementation, potential ramifications for the financial landscape, and challenges associated with their adoption.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touch