Commercial & Corporate Banking

Automated financial analysis reduces manual effort

Client

Commerical lending and credit risk units of large North American bank

Goal

Automated retrieval of information from multiple financial statements enabling data-driven insights and decision-making

Tools and Technologies

OpenAI API (GPT-3.5 Turbo), LlamaIndex, LangChain, PDF Reader

Business Challenge

A leading North American bank had large commercial lending and credit risk units. Analysts in those units typically refer to numerous sections in a financial statement, including balance sheets, cash flows, and income statements, supplemented by footnotes and leadership commentaries, to extract decision-making insights. Switching between multiple pages of different documents took a lot of work, making the analysis extra difficult.

Solution

Many tasks were automated using Gen AI tools. Our steps:

- Ingest multiple URLs of financial statements

- Convert these to text using the PDF Reader library

- Build vector indices using LlamaIndex

- Create text segments and corresponding vector embeddings using OpenAI’s API for storage in a multimodal vector database e.g., Deep Lake

- Compose graphs of keyword indices for vector stores to combine data across documents

- Break down complex queries into multiple searchable parts using LlamaIndex’s DecomposeQueryTransform library

Outcomes

The solution delivered impressive results in financial analysis, notably reducing manual efforts when multiple documents were involved. Since the approach is still largely linguistic in nature, considerable Prompt engineering may be required to generate accurate responses. Response limitations due to the lack of semantic awareness in Large Language Models (LLMs) may stir considerations about the usage of qualifying information in queries.

Our experts can help you find the right solutions to meet your needs.

Home » Services » Automation » Page 4

The State of Central Bank Digital Currency

Innovations in digital currencies could redefine the concept of money and transform payments and banking systems.

Do you trust your data?

Data driven organizations are ensuring that their Data assets are cataloged and a lineage is established to fully derive value out of their data assets.

Central banking institutions have emerged as key players in the world of banking and money. They play a pivotal role in shaping economic and monetary policies, maintaining financial system stability, and overseeing currency issuance. A manifestation of the evolving interplay between central banks, money, and the forces that shape financial systems is the advent of Central Bank Digital Currency (CBDC). Many drivers have led central banks to explore CBDC: declining cash payments, the rise of digital payments and alternative currencies, and disruptive forces in the form of fin-tech innovations that continually reshape the payment landscape.

Central banks are receptive towards recent technological advances and well-suited to the digital currency experiment, leveraging their inherent role of upholding the well-being of the monetary framework to innovate and facilitate a trustworthy and efficient monetary system.

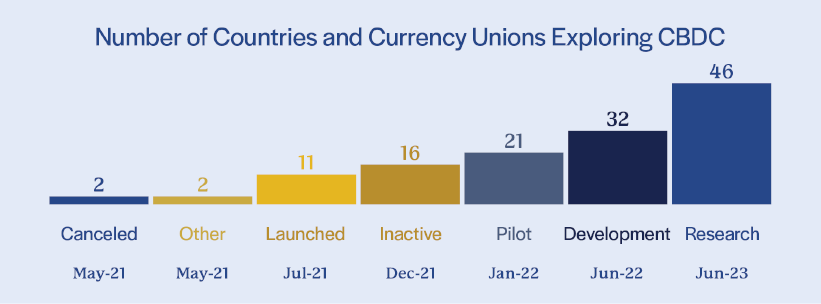

In 2023, 130 countries, representing 98% of global GDP, are known to be exploring a CBDC solution. Sixty-four of them are in an advanced phase of exploration (development, pilot, or launch), focused on lower costs for consumers and merchants, offline payments, robust security, and a higher level of privacy and transparency. Over 70% of the countries are evaluating digital ledger technology (DLT)-based solutions.

While still at a very nascent stage in terms of overall adoption for CBDC, the future of currency promises to be increasingly digital, supported by various innovations and maturation. CBDC has the potential to bring about a paradigm shift, particularly in the financial industry, redefining the way in which money, as we know it, exchanges hands.

Read our perspective paper to learn more about CBDCs – the rationale for their existence, the factors driving their implementation, potential ramifications for the financial landscape, and challenges associated with their adoption.

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchRelease automation reduces testing time by 80%

Client

A leading multi-level marketing company

Goal

Shorten the release cycle and improve product quality

Technology Tools

Amazon CloudWatch, Elasticsearch, Bitbucket, Jenkins, Amazon ECR, Docker, and Kubernetes

Business Challenge

The client's Commercial-off-the-shelf (COTS) applications were built using substandard code branching methods, causing product quality issues. The absence of a release process and a manual integration and deployment process were elongating release cycles. Manual configuration and setup of these applications were also leading to extended downtime. Missing functional, smoke, and regression test cases were adding to the unstable development environment. The database migration process was manual, resulting in delays, data quality issues, and higher costs.

Solution

- Code branching and integration strategy for defects / hotfixes in major and minor releases

- Single-click application deployment, including environment creation, approval and deployment activities

- Global DevOps platform implementation with a launch pad for applications to onboard other countries

- Automated configuration and deployment of COTS applications and databases

- Automation suite with 90% coverage of smoke and regression test cases

- Static and dynamic analysis implementations to ensure code quality and address configuration issues

Outcomes

Automation of release cycles delivered the following benefits to the client:

- Release cycle shortened from once a month to once per week

- MTTR reduced by 6 hrs

- Downtime decreased to <4 hours from 8 hours

- Product quality and defect leakage improved by 75%

- Testing time reduced by 80%

- Reach expanded to global geographies

- Availability, scalability, and fault tolerance enhanced for microservices-based applications

Our experts can help you find the right solutions to meet your needs.

DevOps solution improves scalability by 5x

Client

North America-based fertility and genomics company

Goal

Expand business reach, reduce time-to-market, and support critical compliance

Technology Tools

.NET 5, Vue.js, AWS Secrets Manager, AWS Transfer Family, Amazon RDS, Amazon EKS, Amazon Route 53, Amazon CloudFront, Terraform, GitLab

Business Challenge

The client wanted to expand its reach to Canada, Europe, and APAC regions to meet the requirements for a 10x increase in their user base. Legacy application infrastructure and code built on the old tech stack, with high technical debt, were slowing down the rollout of new features, making the client less competitive. The infra-deployment process was only partially automated, stretching the time-to-market to three months. The total cost of ownership was relatively high. HIPPA and PII compliance were also not supported.

Solution

Iris modernized the application into microservices, built the infrastructure using Terraform and automated its provisioning and configuration.

- Application developed using .NET 5 and Vue.js

- Architecture transformed into cloud-native

- AWS Managed Services, including Secrets Manager, AWS Transfer Family, RDS, EKS, Route 53, CloudFront, and S3, configured using Terraform

- EKS Cluster and associated components provisioned via Terraform

- App pushed to container registry using GitLab pipeline

- Secrets (API keys, database connection strings, etc.) and app images moved to EKS Cluster using S3 Bucket Helm

- Static code analysis, coverage and vulnerability scans integrated to ensure code quality and reduce configuration issues

Outcomes

- Application launch in Canada and Europe; Asia Pacific release in the pipeline

- HIPPA and PII compliance

- 5x scalability improvement from weekly average usage

- Time-to-market reduced from three months to 3 weeks

- Total cost of ownership lowered by 50%

Our experts can help you find the right solutions to meet your needs.

Order management platform transformation

Client

Multinational publishing, media, and educational company

Goal

Improve order management and transaction processing capabilities

Technology Tools

AWS EKS, Kong, Salesforce Commerce Cloud (SFCC), Salesforce CRM, Jenkins, Sumo Logic, Datadog

Business Challenge

The client's order management platform was complex and had scalability issues, causing poor customer experience and loss of revenue. The platform was hosted on Oracle cloud, with data stored in different repositories. Services were also hosted in the Oracle cloud, which used the BICC extract to fetch information about order details from Oracle databases. The low performance of customer-facing applications was causing latency and very high transaction processing time.

Solution

Team Iris transformed Oracle-based SOA services into six microservices and migrated them to AWS EKS for autoscaling with self-healing and monitoring capabilities.

We developed services for publishing data to Salesforce CRM for quick order processing and conversions. The BICC system for diversified information and order history was enabled with real-time integration between Oracle Fusion and materialized views for data consumption.

Post migration, these services were registered in Kong for discovery, and a CI/CD pipeline was created for deployment using Jenkins. Sumo Logic was used for monitoring the logs, and Datadog was used to observe latency, anomalies and other metrics.

Outcomes

The order management platform transformation delivered the following benefits to the client:

- System performance improved by 70%

- Transaction processing capability increased by 4x

- Order processing capabilities were enhanced by 200%

- Total cost of ownership (TCO) was reduced by 30%

Our experts can help you find the right solutions to meet your needs.

Quality engineering for Blockchain-DLT platform

Banking & Financial Services

Next-gen Quality Engineering for Blockchain-DLT platform

Quality engineering implementation helps a digital financial services client smooth the legacy migration of its Blockchain-DLT (Digital Ledger Technology) platform by advancing automation coverage and patch delivery efficiencies.

Client

A leading digital financial services company

Goal

Blockchain- DLT platform assurance with improved automation coverage

Tools and technologies

Amazon Elastic Kubernetes Service (EKS), Azure Kubernetes Services (AKS), Docker, Terraform, Helm Charts, Microservices, Kotlin, Xray

BUSINESS CHALLENGE

The client's legacy DLT platform did not support cloud capabilities with the Blockchain-DLT tech stack. The non-GUI (Graphic User Interface) and CLI (Command Line Interface)-based platform lacked the microservices architecture and cluster resilience. The REST (Representational State Transfer) APIs-based platform did not support platform assurance validation at the backend. Automation coverage for legacy and newer versions of the products was very low. Support for delivery patches was insufficient, impacting the delivery of multiple versions of R3 products each month.

SOLUTION

Iris developed multiple CorDapps to support automation around DLT-platform functionalities and enhanced the CLI-based & cluster utilities in the existing R3 automation framework. The team implemented the test case management tool Xray to improve test automation coverage for legacy and newer versions of the Corda platform, enabling smooth and frequent patch deliveries every month. The quality engineering process was streamlined for the team's Kanban board by modifying the workflows. Iris also introduced the ability to execute a testing suite that could run on a daily or as-needed basis for AKS, EKS, and Local MAC/ Windows/ Linux cluster environments.

OUTCOMES

The Blockchain-DLT reliability assurance solution enabled the client to attain:

- Improved automation coverage of the DLT platform with 900 test cases with a pass rate of 96% in daily runs

- Compatibility across AWS-EKS, Azure-AKS, Mac, Windows, Linux, and local clusters

- Increased efficiency in deliverables with an annual $35K savings in the test case management area

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchTest Automation Speeds Model Risk Management System

Client

Top international bank

Goal

Fully automate the model risk management system framework to improve quality and confidence in testing results

Tools and technologies

Java, Selenium, Maven, TestNG, Git

BUSINESS CHALLENGE

The client's existing model risk framework was inefficiently handling functional testing aspects and risk scenarios due to lack of an end-to-end testing framework. Built on redundant, hard-to-debug, and non-scalable code, the system was unreliable for model risk testing. Test cases and controls were maintained and executed in Excel, eliminating parallel workflow abilities, tempering testing results, contributing to increased testing efforts and even delaying production launches in some cases. Scalability of testing using automation, running data-driven, end-to-end test flows, and restoring confidence in test results were the client's prime challenges.

SOLUTION

Iris built a lightweight and scalable new framework, providing 100% automated regression testing of functional test cases. Using simplified, customizable code that separated automation utilities and test functions, Iris' solution brought multiple improvements. Among them was faster test execution due to significantly reduced manual efforts. It also resulted in better quality and stability from the early identification of testing issues, enabling immediate corrective actions to occur. Another advantage of the solution was adaptability to multiple application areas due to ease of maintainability and traceability of code employed.

OUTCOMES

The client experienced several positive effects from the new, fully-automated solution:

- Acquired a 100% stable, scalable, reusable test framework

- ROI of 72%; payback period of less than 8 months

- 20% reduction in testing efforts for faster time to market

- Significant decrease in time required for ongoing maintenance of test scripts

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchDigital ledger secures trading integrity

Client

Global bank's trading operations

Goal

Resolve trading transaction breaks and related regulatory issues through expandable intra-company digital ledger system

Tools and technologies

Hyperledger Fabric 1.4/2.2, Java 8, Go Language 1.8, Kafka, Node JS, Microservices, OpenShift, Dockers, Kubernetes

BUSINESS CHALLENGE

A highly-manual, paper-dependent, trading and reconciliation process was causing the accumulation of a large number of daily transaction liquidity breaks, which had been cited by federal regulators and risked a billion dollar cost impact. The lack of a robust trade audit and reconciliation process to reduce liquidity breaks and operating costs led the bank to seek an immutable system that could record and unify financial practices and be expanded to other transaction areas.

SOLUTION

Iris' solution comprised a production-ready, configurable platform using microservices and blockchain-based digital ledger architecture. It employed Smart Contracts coded with requisite business rules to facilitate front office trade booking and trade reconciliation processes. RPA was utilized to automate data mapping and testing of transactions. Preventive controls were enabled by recording intra-company transactions at their initiation using uniform booking practices, and consequently guaranteeing the term of the trade. A multi-layered infrastructure was created to support real-time, batch streaming of differing file formats. The UX was enriched through Interactive UI and automated workflows.

OUTCOMES

Iris successfully introduced a global intra-company distributed ledger and trade reconciliation system that did not exist before. With self-executing contracts matching both sides of transactions prior to feeding downstream systems, the platform ensures complete integrity at the source and reduces time and cost for all transactions. The solution also achieved:

- 30% fewer liquidity breaks

- 70% improvement in operational efficiency due to the use of RPA

- 60% reduction in business-rules configuration time, due to the smart contracts

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchSoftware transformation gets compliance for bank

Client

A global investment bank

Goal

To have a unified functional validation system for FDIC compliance

Tools and technologies

SQL Server, Sybase, Data Lake, UTM, .NET, DTA, Control-M, ALM, JIRA, Git, RLM, Nexus, Unix, WinSCP, Putty, Python, PyCharm, Confluence, Rabacus, SNS, and Datawatch

BUSINESS CHALLENGE

SOLUTION

OUTCOMES

- Faster and more efficient internal analysis with highly accurate QFC open positions

- 100% compliance with timing and format of required daily QFC report submissions to the FDIC

- Significant decrease in exceptions before the platform went go-live and zeroed critical defect delivery post-go-live

- An intuitive UI dashboard reflecting the real-time status of critical underlying data volumes, leakages, job run, and other stats

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchTech stack automation expedites script development by 3x

Manufacturing

Tech stack automation expedites script development by 3x

Manual processes across the multi-technology stack were severely affecting the script development cycles in terms of time, effort and cost. Iris application agnostic Test Automation framework and DevOps integration helped the client reduce the script development time and cost significantly.

Client

A leading building supplies manufacturing company

Goal

To support 30+ applications stack for UI, E2E, APIs, performance, mobile automation along with DevOps pipeline integration

Tools and technologies

.NET Core, PeopleSoft, Salesforce, WMS, JavaScript, Angular, Foxpro, C#, Selenium, SpecFlow, RestSharp, Nunit, Mobile Center/Emulators, Allure, Jira, Azure Pipeline, GitHub

BUSINESS CHALLENGE

The client had technology stacks comprising of diverse technologies that were difficult to manage. Substantial manual effort and time were spent on integrating the checkpoints, elongating the development process. Validating end-to-end business flows across different applications was the prime challenge. Reporting processes were also scattered across the entire application stack, making it vulnerable.

SOLUTION

Iris developed a robust application agnostic Test Automation framework to support the client’s multiple-technology stacks. Following the Behavior-driven Development (BDD) approach to align the acceptance criteria with the stakeholders, we built business and application layers of the common utilities in the core framework. Our experts identified E2E business flows to validate the downstream impact of the change and automated the entire stack through the shift-left approach. Azure DevOps integration enabled a common dashboard for reporting. The client attained complete version control to track production health and enforce strong validations.

OUTCOMES

Iris Automation solution enabled the client to surpass several business goals. The key outcomes of the delivered solution included:

- ~65% Increase in automation coverage

- 100+ Pipelines for in-scope applications across multiple environments

- 3700+ Test Automation scripts execution per sprint cycle achieved across applications

- 3X Faster script development of behavior-driven test cases

- Multi-day manual test effort reduced to a few hours of automated regression

- 70% Reduction in effort

Contact

Our experts can help you find the right solutions to meet your needs.

Get in touchIndustries

Company